Welcome to the realm of entrepreneurial empowerment where business owners are driven by the pursuit of strategic excellence to supercharge cash flow, fuel growth and unlock their business’ true potential.

At Carbon, we understand that success in today’s progressive landscape demands innovation and actionable insights to rise above the competition. Having an accountant by your side can prove highly beneficial on your journey as you start, build and grow a successful business.

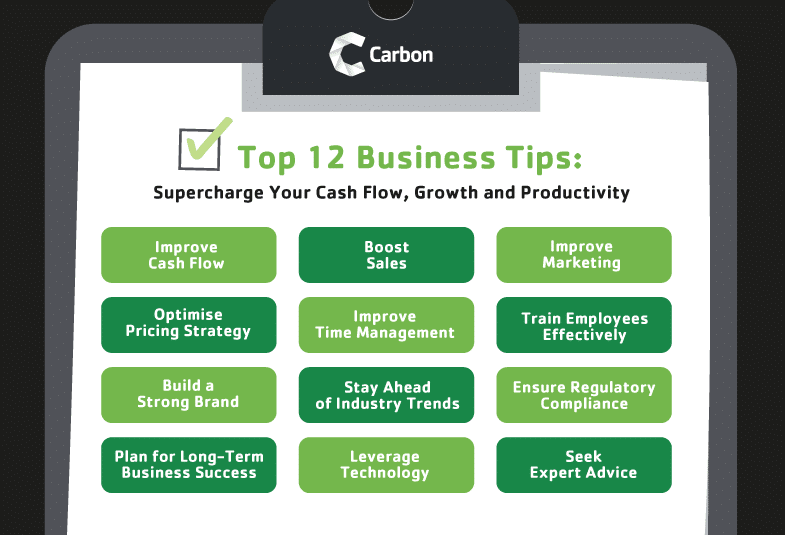

In this guide, we present our top 12 cutting-edge business tips, meticulously crafted to propel your business into a league of its own.

Prepare to redefine your financial management, unleash the full potential of your marketing prowess, optimise your pricing strategy and elevate your brand identity to resonate with your audience like never before.

We believe in staying ahead of the curve by embracing change, vigilantly tracking industry trends and harnessing the power of technology to catapult your productivity. Embark on a transformative journey to revolutionise your business with a progressive mindset and a professional approach to success, starting with our 12 top tips.

Table of Contents

- Improve Cash Flow

- Boost Sales

- Improve Marketing

- Optimising Price Strategy

- Improve Time Management

- Train Employees Effectively

- Build a Strong Brand

- Stay Ahead of Industry Trends

- Ensure Regulatory Compliance

- Plan for Long-Term Business Success

- Leverage Technology

- Seek Expert Advice

- Ready To Build a Successful Business Based on Experienced Advice?

1. Improve Cash Flow

Healthy cash flow is vital for the survival and growth of your business. Learn how to manage cash flow effectively by analysing your business finances regularly, identifying cash flow gaps and implementing strategies to improve collections from customers.

Looking for more cash flow management tips? Read more from our financial experts:

- How To Boost Your Business Cash Flow for Christmas

- 3 Ways to Improve Your Cash Flow

- Increase Your Cash Flow by Improving Your Accounts Receivable

- Tax Planning and Its Effects on Business Cash Flow

- Why Cash Flow Matters and What To Do About It

- Think Cash Flow Planning Is Just for Businesses? Think Again.

- How Inadequate Cash Flow Can Strangle Your Business

2. Boost Sales

It’s a no-brainer – Driving sales is crucial for revenue growth. To excel at this, you should focus on understanding your target audience, clarify your offerings, refine your sales techniques and leverage digital marketing strategies to reach a wider customer base.

These actions will save your business from inevitable changes, such as generational evolution. For more specific tips, refer to our guide on future-proofing your business.

3. Improve Marketing

Customer expectations have transformed, making the customer journey more critical than ever.

Leveraging social media platforms and investing in content marketing can captivate and retain your customers’ attention, building a seamless brand experience that fosters trust and loyalty. Personalisation, influencer partnerships, user-generated content, compelling videos and data-driven analysis are additional tips to consider for a robust and budget-conscious marketing strategy.

We can help you identify your marketing budget sweet spot to avoid burning money that is not working for you.

4. Optimise Pricing Strategy

Setting the right prices for your products or services can significantly impact your profitability. Conduct market research to understand pricing trends and analyse competitors’ strategies. With proper analysis you can ensure your pricing reflects the value you offer.

For more insights and help around managing your business numbers, read our article on the right accounting software for your business.

5. Improve Time Management

If you’re a business owner, you’ve probably read just about every productivity book out there (Atomic Habits anyone?). Time is a precious resource and effective time management can boost productivity and efficiency.

Consider implementing time management techniques like prioritising tasks, setting realistic deadlines and using productivity tools to streamline your workflow.

Here’s a tip:

Use an app (like Toggl Track) to track how long it takes to conduct daily tasks. Then, determine how much that time has cost you. Is it worth your time to do it yourself, or is it time to consider outsourcing?

6. Train Employees Effectively

Your employees are the backbone of your business. As well as investing in their training and development, enhancing their skills and performance, consider investing in boosting team culture and morale.

Well-trained and happy employees contribute to higher productivity and overall business success.

Here’s a tip:

Struggling to find employees to grow your team? Engage a specialist HR consultant to implement progressive strategies that attract top talent.

7. Build a Strong Brand

Your branding is the face of your business, a feeling people get when working with you and the ability to be easily identifiable. It creates an emotional connection with your target audience that fosters trust and loyalty.

Investing in your brand’s identity, customer experience and consistent messaging, will unlock the full potential of your business, building a brand that resonates and thrives.

To create a unique brand experience using automation, check out our small business growth hacks guide.

8. Stay Ahead of Industry Trends

Keep a close eye on industry trends, innovations and emerging technologies. Staying informed about the latest developments in your industry will help you make informed decisions and adapt your business strategies accordingly.

9. Ensure Regulatory Compliance

Complying with legal and regulatory requirements is essential for business operations. Stay updated on relevant laws, licences and permits to avoid potential penalties or legal issues.

Building a team of professionals that can assist and advise in these areas will help you avoid red tape issues down the road.

10. Plan for Long-Term Business Success

Set clear long-term goals and create a comprehensive business plan that outlines your strategies and objectives. Regularly review and adjust your plan to align with changing market conditions and business goals.

We recommend scheduling this time with your team at least quarterly. During this time reflect and adjust your actions to get you closer to your target. By doing this, you are holding yourself and your team accountable for their goals.

Looking for more tips on goal setting and achieving business success?

- 10 Tips for Achieving Financial Goals and Business Success

- How To Set Achievable Financial Goals for The New Year

- Beginner’s Guide: How to Achieve Financial Success

- Get Ready For EOFY: The Ultimate Business Owner’s Checklist

- What Is a Business Model Canvas and Why You Need One ASAP

11. Leverage Technology

Embrace technology to automate repetitive tasks, enhance communication and improve overall efficiency. Implementing the right software and tools can streamline business processes and save time and resources.

Read more about business systems, accounting software and outsourcing:

- How do I know when it’s time to hire a bookkeeper?

- Best Accounting Software to Integrate With Your Shopify Store in 2023

- Top six reasons why Xero is the right accounting software for your business

- Accounting Software MYOB

- Chaser: Debtor Management

12. Seek Expert Advice

Finally, don’t hesitate to seek expert advice from business coaches, mentors and accounting professionals. Their insights and experience can provide valuable guidance to help you make informed decisions, save time and navigate various challenges.

Ready to build a successful business based on experienced advice?

For professional guidance that gets your business moving in the right direction, speak to our team of experts at Carbon. We do more than help you start, we help support your venture into the future.

Checkout more of our articles or just give us a call on 1300 454 174 for the answers you seek regarding accounting and tax, bookkeeping, virtual CFO services, financial planning, start-up investments, insurance brokers, and finance and lending.