Reduce your stress from trying to manage your BAS on your own.

A Business Activity Statement (BAS) is a tax reporting obligation for all businesses issued by the Australian Taxation Office (ATO). It’s essentially a summary of all the taxes you have paid or need to pay during a specified period.

The type and amount of taxes you’re required to pay depend on several factors such as company size, number of employees, benefits offered, type of products or services and location in Australia. Here is a list of mandatory and additional taxes businesses are required to pay:

Registered businesses might be required to lodge their BAS either every month, every quarter or every year. There are strict due dates for the lodgment of your BAS and penalties apply if you are late in lodging.

The ATO determines the BAS lodgment cycle, and all BAS lodgments must be accurately submitted on time or you will face penalties, which is why it’s beneficial to have an expert like Carbon to manage your BAS lodgments.

BAS Lodgment due date for each quarter:

|

Quarter |

Due date |

|---|---|

| 1. July, August and September | 28 October |

| 2. October, November and December | 28 February |

| 3. January, February and March | 28 April |

| 4. April, May and June | 28 July |

The due date to lodge and pay your monthly BAS is the 21st day of the month following the end of the taxable period. For example, a July monthly BAS is due on 21 August.

If your GST turnover is $20 million or more, you must report and pay GST monthly and lodge your activity statements online. Schools and associated bodies are automatically granted a deferral of their December activity statement. These will be issued with a deferred due date of 21 February.

The business activity statement (BAS) due date to lodge and pay your annual GST return is 31 October.

If you aren’t required to lodge a tax return then the due date for your BAS is 28 February following the annual tax period.

Accounts management is a specialist skill, and doing it yourself can lead to costly errors and lost time! So here’s why you should outsource your BAS Lodgments:

Find out how easy Carbon can help you with your BAS lodgments.

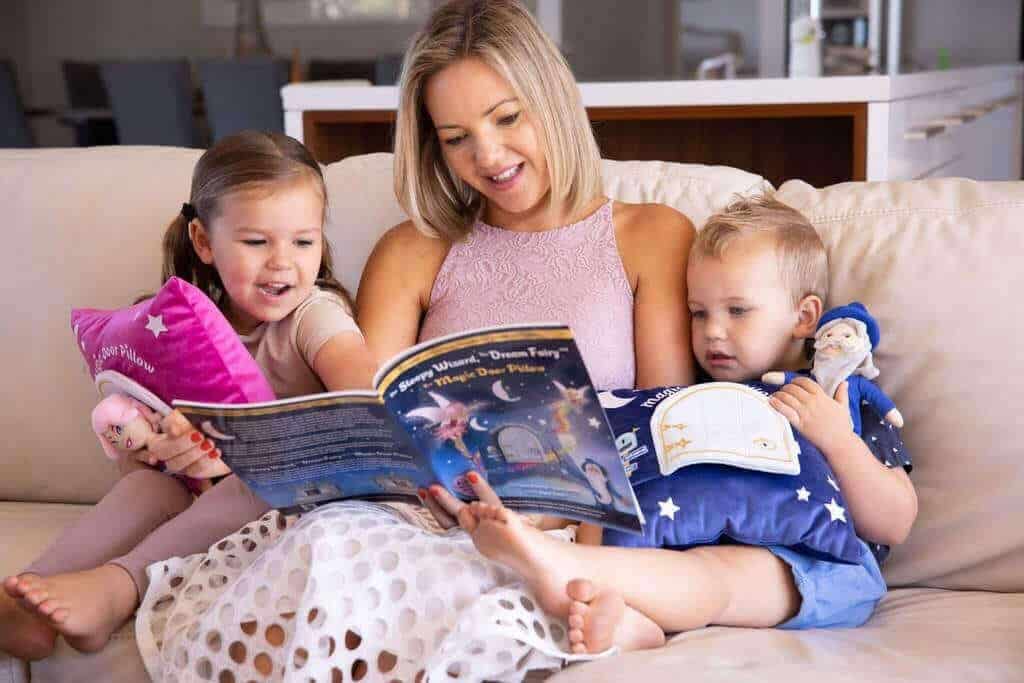

Magic Door Pillows is an online small business dedicated to creating a magical bedtime routine that makes any child excited to go to bed. Having worked with Carbon’s accountants in Perth on previous projects, the business owner knew he wanted all his bookkeeping processes set up correctly from the get-go.

From the beginning, Carbon has taken care of all Magic Door Pillow’s bookkeeping needs including quarterly BAS lodgments. Since launching, Magic Door Pillows has had less stress and can relax knowing all important documents are being submitted on time. Read our case study for more information.

BAS (Business Activity Statement) is a form submitted to the ATO by businesses to report and pay various tax obligations including GST, PAYG instalments, PAYG withholding and other taxes.

Yes, you can lodge your BAS yourself via the ATO Business Portal or myGov if you’re a sole trader. But many business owners choose to engage a BAS agent due to the complexity of tax obligations and the risk of non-compliance.

Using a BAS agent is often a better option if:

You’re short on time or overwhelmed by admin.

Your business has employees, GST or complex transactions.

You’ve lodged late or made errors in the past.

A BAS agent like Carbon ensures your BAS is submitted on time and without errors, while also helping you manage cash flow and stay on top of other reporting obligations.

Keeping good records helps you stay on top of your business. Remember to:

A registered BAS agent is a qualified professional authorised by the Tax Practitioners Board (TPB) to provide BAS services, including preparing and lodging your Business Activity Statement with the ATO. To become registered, they must meet strict education, experience and ongoing professional development requirements. BAS Agents:

Ensure your BAS is accurate and compliant.

Are up to date with the latest ATO requirements and tax laws.

Can liaise with the ATO on your behalf, helping resolve issues.

Ensure you avoid costly mistakes, missed deadlines and unnecessary stress.

At Carbon, our BAS agents are experienced bookkeepers and registered professionals who handle BAS reporting for businesses of all sizes.

The ATO determines your BAS lodgment cycle and it’s important you meet the deadlines or you will face penalties.

If you do your own BAS lodgments, then they are due to the ATO on the 28th of the month following the end of the accounting period. If you use a tax agent like Carbon, the lodgment date is two months after the end of the accounting period.

If the due date is on a weekend or public holiday, you have until the next business day to lodge and pay.

Missing the deadline can result in penalties and interest charges. It’s crucial to lodge on time to avoid these additional costs.

Even if you can’t pay by the due date, you still need to lodge your BAS on time. This will give you certainty of your position with the ATO and shows you’re aware of your obligations and doing your best to meet them.

Read more: Strategies For Minimising Errors In Your BAS Submission

You are probably aware that it’s compulsory to lodge your BAS at least quarterly, but maybe you have some overdue. Perhaps you were too busy, the forms were too complicated, or there was an unforeseen circumstance that stopped you from lodging your BAS with the ATO. Don’t worry, it’s very common and with the right help the problem can be fixed easily. Whatever the reason you fell behind, you need to get up to date and doing so will help you get a better night’s sleep.

The easiest way to get back on track is to get in touch with Carbon Bookkeeping & CFO Services, registered BAS Agents. We’ve dealt with all different types of situations, and can guarantee we’ve seen, and fixed, a lot worse.

Yes, our team can assist in preparing and lodging overdue BAS statements, and help you manage any penalties or interest charges.

When you partner with Carbon, your dedicated BAS agent will:

Collect and review your financial data, either from your accounting software or records.

Reconcile transactions and ensure all GST, PAYG and other obligations are correctly calculated.

Prepare your BAS and submit it to the ATO on your behalf via the secure BAS Agent Portal.

Communicate due dates and payment info, and can assist with setting up payment plans if needed.

Handle any ATO correspondence or issues that arise after lodgment.

We also provide reminders and ongoing support so you never miss a deadline again. It’s BAS lodgment, made simple.

In certain circumstances, the ATO allows payment plans for BAS liabilities. We can assist you in setting up a suitable arrangement.

To find out more about how Carbon can help you with your BAS lodgments, simply fill in the form below.