Does setting financial goals take your business to the next level? The answer is a unanimous yes from Carbon. Setting financial goals lets you concentrate your resources and efforts on the most critical areas, leading to long-term growth and profitability.

“In small business, it is vital to know what you working towards. Setting financial goals enables you to know what you are working towards, and measure how you are travelling along the way”, says Michelle Maynard, Carbon Accounting & Tax Partner.

Without a clear financial plan, it can be difficult for businesses to realise their potential and stay competitive. To ensure success you must establish effective financial strategies to reach your goals.

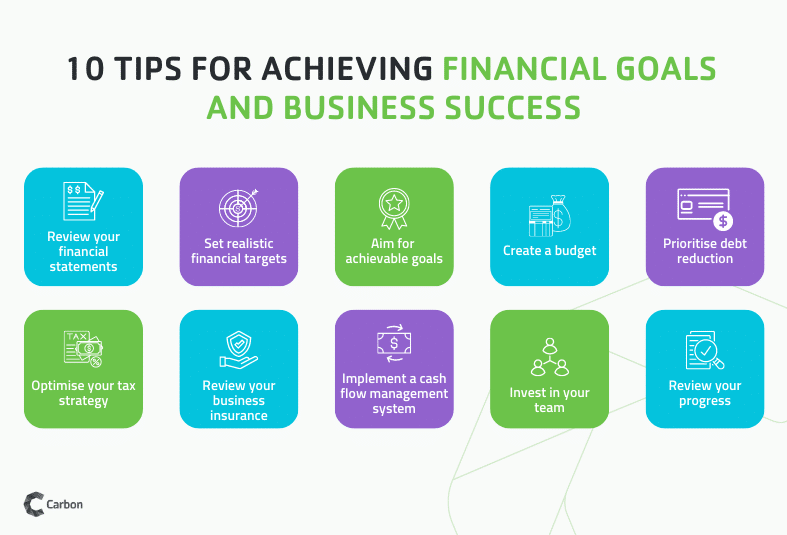

Here are Carbon’s ten tips for business owners wanting to set achievable and realistic financial goals for a new financial year.

Table of Contents

- Review your financial statements

- Set realistic financial targets

- Aim for realistic goals

- Create a budget

- Prioritise debt reduction

- Optimise your tax strategy

- Review your insurance coverage

- Implement a cash flow management system

- Invest in your team

- Review your progress

- Cost-effective ways to improve your financial literacy

1. Review your financial statements

Reviewing your financial statements is crucial in setting financial goals for your business. Regular statement reviews allow you to clearly understand your business’ financial health and identify improvement areas. For example, if your expenses exceed set spending targets, you can look for ways to reduce costs and increase profitability. On the other hand, if your revenue is growing steadily, exploring ways to capitalise on this growth is a great way to expand your business.

Imagine you’re a small retail business owner and have just reviewed last year’s financial statements. You notice that your expenses are higher than your revenue but you’re not sure why. Maybe you’ve overspent on inventory or have unnecessary overhead costs. Unfortunately, you’re already working 60 hours a week and don’t have the time or energy to analyse your financial data beyond reading bank statements.

One solution is outsourcing your accounting and bookkeeping services to someone who can examine your financial data and report back to you. If reading financial statements is something you struggle with, an accountant or bookkeeper can provide expert insights that can help improve your business. When you understand your financial statements, you can then identify the root cause of high expenses, set realistic financial objectives and work towards achieving them.

2. Set realistic financial targets

It’s important to set achievable goals for the new financial year. Yet setting financial goals for a business is challenging for several reasons. Firstly, it requires a deep understanding of the business’ past financial performance and future growth potential. Gaining this financial insight involves analysing financial statements and market trends along with forecasting future revenue and expenses.

Secondly, setting realistic and achievable goals that align with the business’ overall strategy and vision is essential. This requires careful planning and consideration of various factors that may impact the business’ financial performance.

Financial goals can also be affected by external factors beyond the business owner’s control such as changes in the economy, industry regulations or unexpected events like natural disasters or pandemics. These factors can make it difficult to accurately predict future revenue and expenses, making it harder to set achievable financial goals.

Carbon’s Accounting & Tax services can help business owners overcome these challenges by providing expert guidance on setting realistic and achievable financial goals.

It’s not uncommon for business owners to prioritise setting business goals over personal goals but it’s essential to remember that both are equally important for financial success. Don’t overlook the importance of setting achievable personal goals. If you’re interested in improving your personal goal-setting strategies, check out our blog here.

3. Aim for realistic goals

Maximising success means breaking your financial goals into smaller, achievable tasks to make them more manageable. For instance, if your financial plan is to increase revenue by 20 per cent in the next financial year, break that goal down into smaller tasks like identifying new target markets, developing new products or services and increasing your marketing efforts. If you don’t have the expertise in-house, our team can help you create a roadmap for achieving your goals. This ensures you stay on track and can keep an eye on your progress.

4. Create a budget

Creating a budget for the new financial year based on your goals and past performance is crucial. However, as a busy business owner finding the time and energy to focus on your finances is often challenging. Working with an accounting expert can be a game-changer for those who struggle with their budget. At Carbon, we take the hassle out of budgeting and provide you with accurate financial forecasts that you can use to make informed decisions about the future of your business.

5. Prioritise debt reduction

To prioritise debt repayment and focus on business growth, create a plan to pay the debt off faster. For instance, if your company has a credit card debt of $50,000 at an 18 per cent interest rate, paying only the minimum monthly payment of $1,250 will cost over $80,000 and take more than five years to pay off. However, working with Carbon’s experienced advisers means you have access to strategic advice. For instance, a larger monthly payment of $2,500 will enable you to pay off the debt in just over two years, saving $20,000 in interest charges and freeing up monthly cash flow for investing in business growth.

6. Optimise your tax strategy

Optimising your business’ tax strategy is crucial to taking advantage of all available tax benefits. Carbon provides tax planning and compliance services to help you identify tax-deductible expenses and credits which can help you reduce your tax liability. For example, businesses can deduct office supplies, equipment and travel expenses. Additionally, investing in research and development activities may make a company eligible for a tax credit. Our R&D specialists can determine your eligibility for the R&D Tax Incentive and can help with your claim. By saving money on taxes, you can reinvest that money into your business to support growth initiatives such as investing in new equipment or hiring additional employees.

7. Review your insurance premiums

Having adequate and up-to-date insurance is essential to protect your business against unexpected events. For instance, let’s look at ABC Company – a small business that sells handmade products online. ABC Company’s comprehensive insurance policy included property damage, theft and liability coverage. One day, a fire broke out in the warehouse where they stored their inventory. The fire caused extensive damage to the building and destroyed most of its products.

Thanks to their level of insurance, ABC Company was able to recover from the financial losses caused by the fire. The insurance company paid for the damage to the building and covered the cost of replacing the lost inventory. Without insurance, the company would have had to bear the entire cost of the damage which would have been financially devastating.

If it’s been more than a year since you reviewed your insurance policies or your circumstances have changed, get in touch with our insurance brokers. We can help you identify gaps in your premiums and ensure you’re fully protected.

8. Implement a cash flow management system

Effective cash flow management is key to the success of any business. For example, let’s say a business has poor cash flow management and has not kept track of its cash inflows and outflows. As a result, they cannot pay their suppliers on time, leading to delayed shipments and unhappy customers. Furthermore, they miss out on opportunities to purchase inventory at a discounted price because they do not have the cash on hand to make the purchase. This results in lost sales and reduced profitability.

On the other hand, a business that manages its cash flow effectively clearly understands its financial situation. Such companies have a well-established system to monitor their cash inflows and outflows. With these systems in place, making informed decisions about when to pay suppliers, purchase inventory or invest in growth opportunities is more manageable. As a result, business owners can take advantage of opportunities, maintain good relationships with their suppliers and customers and achieve sustainable growth and profitability.

If you’re looking to increase your cash flow, there are many ways you can do this. Read more about improving cash flow through various financing activities or improving your accounts receivable process.

9. Invest in your team

Investing in your team’s training and development helps them grow and take on more responsibility which in turn helps your business thrive. Keep in mind that investing in employee training and development can be costly so astute financial management is crucial. By managing expenses, controlling costs and budgeting effectively, you ensure your business has the necessary funds to invest in your team’s growth and development. Moreover, investing in employee training and development also improves employee retention rates. Employees who feel supported and encouraged to develop their skills will likely stay with a company long-term. Long-term staff retention helps businesses save on recruitment and training costs associated with high employee turnover rates.

10. Review your progress

Regularly reviewing your progress towards your financial goals and making adjustments as necessary is vital to stay on track. Finding ways to stay motivated and accountable is essential such as setting up reminders or rewards for hitting financial targets.

Elevate your business to new heights this financial year by setting effective financial goals.C

Cost-effective ways to improve your financial literacy

Millions of Australians feel ill-equipped to make financial decisions and this lack of financial literacy is now being coined the “Deer in the headlights” effect. Carbon’s Accounting & Tax Partner, Michelle Maynard, sits down with Channel 9 to shed more light on this and how everyday Australians can improve their financial literacy skills for free.

Setting financial goals and developing a solid financial plan is essential for the success of any business. It requires a deep understanding of your business’ financial health, market trends and careful planning to set realistic and achievable goals. Working with an experienced accounting firm like Carbon can provide you with the expertise, insights and resources to create and implement a strong financial plan that helps you achieve your business and personal goals. Contact us today to learn more about how we can help you reach your financial goals.