Have you been considering diversifying your portfolio? Have you determined the best strategies for managing your tax? Have you considered what options offer short-term versus long-term financial rewards?

In this article, our financial planners highlight major considerations for wealth creation that you, as a medical professional, might be missing out on. Learn the tips, strategies and processes that we implement for doctors wanting to take a proactive approach to build wealth, hit financial milestones and live a financially free life.

Table of Contents

Achieve Financial Goals as a Doctor

Picture yourself walking into a patient’s room, ready to diagnose and treat their ailment. As you begin your examination, you notice that the patient is distressed and struggling with various symptoms. You quickly realise that to provide effective care, you need more than just a general understanding of their condition. You need a holistic approach and a comprehensive treatment plan that leaves no aspect of their health unaddressed.

Similarly, when it comes to your finances, you hold the power to shape your own success story. A masterfully crafted financial plan acts as your prescription for long-term prosperity. It weaves together every element of your economic life, harmonising each component to create a vibrant and thriving future.

There are many intricacies when creating effective strategies that set you up for life. There are also standards, regulations and eligibility that need to be met. To get the most from our outlined recommendations, we always advise seeking help from professionals. It all starts at the beginning, creating the foundations with a clear, relevant and manageable plan.

If you are unsure about why you should consider using a qualified financial planner to guide you through this step, you can refer back to our previous article, 7 reasons why doctors need financial planners.

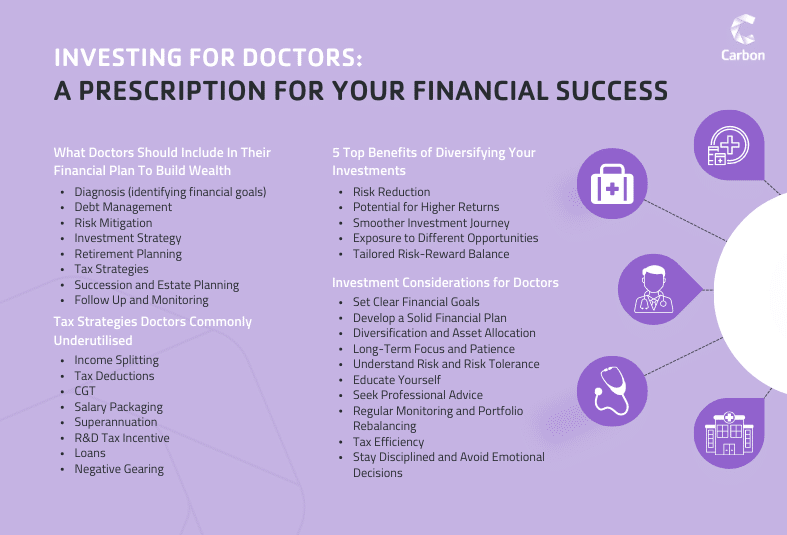

What Doctors Should Include In Their Financial Plan To Build Wealth

Before diving straight into the deep end (making investments), you need to identify your goals, understand where you are at present and then determine the incremental steps needed to get to your desired destination. Having a wider perspective allows you to make smarter decisions that incur the least amount of risk.

The Diagnosis

Just as in medicine, your financial plan begins with a thorough diagnosis. It helps you identify your financial goals and those milestones that you aspire to achieve. Whether it’s securing a comfortable retirement, funding your children’s education or making significant purchases, your financial plan aligns your objectives and sets you on an unstoppable path to triumph.

Debt Management

Your financial plan isn’t merely a list of goals; it goes beyond that. It examines your financial well-being, taking into account your debt management. By crafting a budget that ensures your resources are well managed and optimally utilised, your plan paves the way for constant cash flow and unyielding success.

Risk Mitigation

Evaluating and mitigating risks will be your lifeline if things don’t follow the path best travelled. It should assess potential risks such as disability, illness or unexpected events and recommend appropriate insurance coverage to protect against potential financial hardships.

Investment Strategy

A well-constructed financial plan should include a tailored investment strategy, custom-fit to your risk tolerance, time horizon and financial goals. At Carbon, we believe investing is a smart way to create passive income, securing long-term financial freedom. Your investment plan should outline the asset allocation, diversification strategy and suitable investment vehicles so that you’re well-equipped to grow your wealth over time. Make sure to speak to your financial planner if you have questions about increasing your passive income or diversifying your investments.

Retirement Planning

Retirement planning plays a crucial role in a comprehensive financial plan. It involves estimating retirement needs, determining the appropriate retirement savings contributions and recommending retirement account options making the transition to retirement much easier and something to look forward to.

Tax Strategies

Just as a vigilant doctor practices preventive care, your financial plan incorporates clever tax planning strategies. It minimises those pesky tax burdens and instead incorporates strategies to maximise deductions, optimise tax efficiency and explore tax planning opportunities.

Succession and Estate Planning

This aspect of financial planning involves creating a plan to manage and distribute assets in line with the individual’s wishes while minimising taxes and administrative complexities. It may include drafting wills, establishing trusts, assigning beneficiaries and considering charitable giving.

By incorporating this into your financial plan, you won’t burden loved ones with attending to these details while they are grieving.

Keep in mind, it takes a lifetime to accumulate wealth. By adding succession planning to your financial plan, you’re provided certainty that this will pass to those you love, setting them up for a prosperous future.

Follow Up and Monitoring

Your financial plan thrives on regular check-ups and adjustments. After all, it is dynamic, adapting to the ebb and flow of your life, accounting for career advancements, shifts in income or evolving financial markets. With each review, your financial journey transforms, growing even more resilient.

Just as you strive to provide the best care for your patients, remember to extend that same level of dedication to your financial health. Embrace the boundless potential of a meticulously crafted financial plan. It’s the narrative that propels you towards an abundant future, empowering you to focus on what truly matters – your patients, your passion and your remarkable well-being.

Tax Strategies Doctors Commonly Underutilised

At Carbon, our financial advisers are well-versed in tax-effective wealth-creation strategies for doctors and medical professionals.

There are many, often neglected, areas to discuss under tax strategies including:

- Income splitting

- Tax deductions

- Capital Gains concessions

- Salary packaging

- Superannuation

- Research and Development Tax Incentive

- Loans, and

- Negative gearing.

The compounding benefits of these strategies will see you grow wealth without taking on too much risk because of the high income earned throughout a lengthy career. However, it’s important to speak with a qualified adviser due to the complexities surrounding tax, especially as a higher-income earner.

Investment Considerations for Doctors

At Carbon, we believe that to live life from a place of abundance and financial freedom, smart investments are the way to grow.

For doctors looking to grow their wealth through investing, here’s an overview of key points to consider:

Set Clear Financial Goals

Define your financial objectives, both short-term and long-term. Identify what you want to achieve, such as saving for retirement, funding education or achieving financial independence. Having specific goals helps shape your investment strategy.

Develop a Solid Financial Plan

As mentioned already, create a comprehensive financial plan that aligns with your goals. This plan should include a budget, savings targets, debt management and an investment strategy. A financial planner can guide you in developing a tailored plan that suits your needs.

Diversification and Asset Allocation

Diversify your investment portfolio across different asset classes such as stocks, bonds, real estate and alternative investments. Asset allocation should be based on your risk tolerance, time horizon, and investment goals. Diversification helps manage risk and potentially enhance returns.

Long-Term Focus and Patience

Investing is a long-term endeavour. Maintain a disciplined approach and avoid reacting to short-term market fluctuations. Patiently allow your investments to grow over time, taking advantage of compounding returns.

Understand Risk and Risk Tolerance

Different investments carry varying levels of risk. Assess your risk tolerance, which is your ability to handle market volatility and potential losses. Balance risk and reward based on your comfort level and financial goals.

Educate Yourself

Take the time to learn about different investment options, investment strategies and financial concepts. Stay informed about market trends and economic indicators. Consider reading books, attending seminars or consulting with financial advisers to enhance your knowledge.

Seek Professional Advice

By working with Carbon, you are leveraging our knowledge and experience in your specialised field. We offer personalised guidance for doctors, help create your investment plan and provide ongoing monitoring and support.

Regular Monitoring and Portfolio Rebalancing

By staying proactive and giving your portfolio the attention it deserves, you’ll keep it in peak condition, just like you do with your patients. If things have shifted, it’s time to rebalance. That means adjusting your investments by buying or selling assets to get them back to your original target mix. It’s like fine-tuning your portfolio to keep it in tip-top shape!

Tax Efficiency

When it comes to your investment decisions, it’s important to be aware of the tax implications. By understanding how taxes can impact your investments, you can make smarter choices to minimise your tax burden. Explore strategies like using tax-efficient investment vehicles, maximising contributions to tax-advantaged accounts and capitalising on available tax deductions or credits. By staying informed and proactive, you’ll be able to make the most of tax benefits while growing your wealth.

Stay Disciplined and Avoid Emotional Decisions

Let’s talk about the role of emotions in investment decisions. We all know that emotions can sometimes cloud our judgement and lead to less-than-ideal outcomes. That’s why it’s crucial to stay disciplined and stick to your well-thought-out investment plan. Resist the urge to make impulsive decisions based on short-term market fluctuations. Instead, take a calm and calculated approach. Remember to carefully evaluate investment opportunities, seek the guidance of professionals and regularly review and adjust your investment strategy as necessary. By staying level-headed and informed, you’ll be on the path to making sound investment choices. Let’s keep your financial journey on track for success!

5 Top Benefits of diversifying your investments

Diversifying your investments offers several key benefits that can help mitigate risk and enhance long-term returns.

To help provide some additional perspective, we have listed the top five advantages of diversification:

1. Risk Reduction

Let’s dive into the power of diversification in your investment portfolio. By spreading your investments across various asset classes, industries, geographic regions and investment types, you’re effectively lowering the overall risk. How? Well, when you have a diversified portfolio, the impact of any single investment or market event is minimised. If one investment underperforms, fear not! Others in your portfolio can step up and offset the losses, giving you a more stable and consistent return profile.

2. Potential for Higher Returns

With a diversified portfolio, you open the door to exciting possibilities. While some investments may experience ups and downs or even negative performance, others can soar and generate positive returns. Having a mix of investments increases your chances of capturing gains from different sectors or asset classes that outperform over time. It’s like harnessing the power of multiple breakthrough treatments to achieve extraordinary results.

3. Smoother Investment Journey

Unlike concentrated portfolios, a diversified one offers a balanced approach that can help minimise volatility. Here’s how it works: when one investment experiences losses, the gains from others can offset them, creating a harmonious equilibrium. This balance reduces the overall volatility of your portfolio, allowing you to maintain focus on your long-term goals without emotions being swayed by short-term market fluctuations. It’s like prescribing a treatment plan that ensures steady progress towards optimal health.

4. Exposure to Different Opportunities

By widening the spread of your investments, you gain access to the potential growth of various industries, regions or sectors. It’s like having a front-row seat to witness emerging trends, technological advancements and economic developments that drive specific areas. This exposure increases your chances of reaping the benefits of these exciting opportunities, much like staying at the forefront of groundbreaking medical breakthroughs to enhance patient care.

5. Tailored Risk-Reward Balance

With portfolio diversification, doctors have the power to tailor their investments based on their unique risk tolerance and investment goals, as established in your financial plan. It’s like prescribing the perfect treatment plan for your financial well-being!

You can allocate your investments across a range of assets, from low-risk options like bonds or cash for stability, to higher-risk assets like stocks or alternative investments for potentially higher returns. It’s all about striking the right balance that aligns with your comfort level and objectives.

Of course, it’s important to note that investment portfolio diversification doesn’t guarantee profits or shield you from losses, and it can’t eliminate investment risks. However, it’s widely recognised as a prudent investment strategy to manage risk and increase the potential for long-term financial success. By implementing these considerations, you can tap into the advantages of diversification and enhance your investment journey.

Embrace the power of diversification and design a personalised approach that sets you on the path to financial success.

Are you in the early stages of building your career as a doctor?

A great aspect of financial planning for growing wealth is the earlier you start, the more you’ll achieve.

Do your long-term strategy and career aspirations include opening your own practice?

Here is an article where our medical accounting specialists share tips for medical practitioners who are thinking of opening up their own practice.

What will you do to grow your wealth?

In an ever-evolving industry, it is important to have a well-rounded strategy that keeps you competitive within the medical space, ensuring a prosperous career. Check out this article, 6 Simple Ways Doctors Can Future Proof their Financial Future.

By incorporating the key points discussed in this article, such as setting clear financial goals, developing a solid financial plan, diversifying your investments, understanding risk and seeking professional advice, you can navigate the complexities of wealth creation with confidence. Remember, just as you provide exceptional care to your patients, extending that same level of dedication to your financial health is essential. Embrace the power of a meticulously crafted financial plan and the advantages of diversification to unlock the boundless potential for your financial well-being. Speak to our financial advisers today to get started on building your wealth.