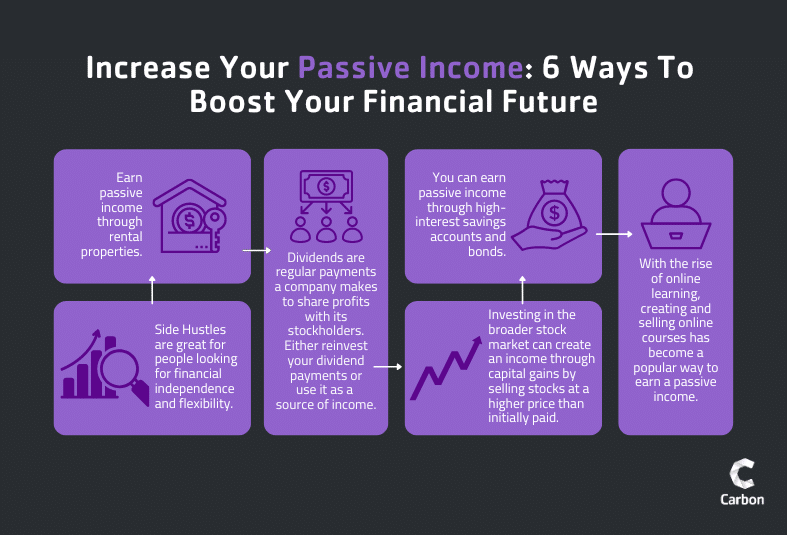

With the challenges of soaring inflation and rising interest rates, many individuals are seeking ways to increase their passive income. But what exactly is passive income and how can you generate it? This article will explore six practical ways to create a passive income and secure a more stable financial future. From investing in dividend-paying stocks to rental properties, online businesses, and more, we will cover various strategies to help you generate passive income and build wealth over time.

Table of Contents

What is a Passive Income?

Passive income is a form of revenue earned without the continuous exchange of time for money. For instance, the traditional way of making a dollar is trading time for money. In other words, your income directly relates to the hours worked or services rendered. But with a passive income, money is generated even when you are not actively working. So instead of solely relying on labour-intensive activities that require ongoing effort, a passive income typically involves leveraging money from investments, assets, or businesses that generate income with minimal or no active involvement. Money generated passively allows you to break free from the conventional “time equals money” mindset and create income streams that work for you long term, providing financial flexibility and potential for wealth accumulation.

Usually, there are three main types of passive income streams:

- Investing: generating a return from investing money in a high-interest saving account, term deposit or the stock market.

- Asset sharing: selling or renting out assets you own, such as your house or car.

- Asset building: examples could include adding revenue-generating affiliate links to your blog or website or selling resources such as ebooks, educational content, music and photos online.

While all these categories have the potential to generate a substantial income, here are some suggestions for earning a passive income in Australia.

1. Rental Income

One of the most well-known ways to earn passive income is through rental properties. For example, if you own a vacation home, you could rent it during peak season and generate yearly income. Similarly, investing in residential or commercial property and renting it out to tenants provides a steady stream of passive income. However, it’s essential to carefully research the location, market demand and potential expenses like maintenance and property management fees before jumping into this investment option.

2. Dividend-paying Stocks

Dividend-paying stocks are another popular choice for passive income. Many established companies offer dividends as a way to share profits with shareholders. By investing in stocks, you can earn regular dividend payments, which can be reinvested or used as a source of income. However, seeking out stocks with a track record of consistent dividend payments is essential, as some companies may reduce or eliminate their dividends due to market conditions. Equally important is realising that cultivating a passive income stream through dividend-paying stocks requires patience, discipline, and a long-term perspective. It takes time for dividends to accumulate and investments to grow.

Yet, investing in the stock market is not without risks. So assessing your risk tolerance, financial goals, and time horizon is crucial before making investment decisions. Seeking guidance from a qualified financial planner is essential for developing a well-rounded investment strategy that aligns with your unique financial situation and passive income goals.

3. Side Hustles

In today’s fast-paced world, where financial independence and flexibility are highly valued, many of us are on the lookout for opportunities to boost our income and take control of our financial future. This is where side hustles come into play. A side hustle is like a part-time gig or project that you pursue alongside your regular job or studies. Examples of side hustles include:

- Start a small eCommerce business on Etsy or Amazon – sell printables, journals or eBook covers.

- Uber/uber eats – spend a few hours on the weekend delivering food and driving people to their destination.

- Airtasker – advertise your practical skills such as IT, carpentry or odd jobs around the house.

- Cleaning homes – you can make some extra money from just doing someone else’s grocery shopping, housekeeping or running errands.

- Rent out your space and/or belongings – there are a variety of platforms at your disposal to rent out your car, spare bedroom, garage, storage, handbags, clothes, prams and toys.

- Social media/content creation – if you have a high level of engagement on your own social media profiles, you could turn this into a mini-business.

- Website and graphic design – use your creativity to your advantage. Get paid to create designs, websites and logos.

- Participating in market research – surveys, taste testing and talking about products and services.

- House-sitting – care for people’s homes, gardens and pets while they’re away.

- Babysitting – care for people’s children while the parents take a much-needed break.

- Walking dogs and pet-sitting – there are a lot of pet owners who are either too busy or physically cannot walk their pets. Get paid to get some fresh air.

- Teaching a skill – such as makeup lessons, cooking classes or photography lessons.

- Freelancing – companies are always looking to outsource or hire someone casually to help with their social media, blog content and IT troubles.

- Paid medical trials – companies conducting medical trials often look for people from a wide variety of backgrounds (make sure you speak to your doctor if you have reasons for concerns) .

- Data entry – virtual office work can be a great option if you are looking to work remotely.

- Become a secret shopper – if you have a good eye for detail, companies will pay for your honest feedback on your shopping experience.

4. Online Courses

With the rise of online learning, creating and selling online courses has become a popular way to earn passive income. If you have expertise in a particular field, you can create online training and sell it on platforms like Udemy, Skillshare, or Coursera. Once the e-learning modules are online, each one offers the potential to generate income as students enrol and access the content. For example, if you’re a professional photographer, you can create an online course on photography techniques and sell it to aspiring photographers worldwide.

5. Investing in the Stock Market

Investing in the broader stock market can create an income through capital gains and selling stocks at a higher price than initially paid. For instance, if you buy stocks at a lower price and sell them at a higher price, the difference represents a capital gain. This gain converts to passive income when you sell the stocks.

Investing in the broader stock market for income also involves receiving stock options. For instance, a company may grant employees or shareholders the right to buy shares in the company’s stock at a specific price. If the stock price increases, excising the stock options and selling at a higher price generates a profit and income.

But, it’s important to note that generating income from the broader stock market involves taking on some risk, as stock prices fluctuate and may not always increase. Careful research, analysis and diversification are essential in managing risks and making informed investment decisions. Consulting with a qualified financial adviser is the best way to develop an investment strategy that aligns with your financial goals and risk tolerance.

6. Interest from Savings Accounts and Bonds

You can earn passive income through savings accounts and bonds. These options are considered safer and can provide you with a steady income.

Savings accounts and term deposits

High-interest savings accounts are a great place to start. They offer a base interest rate and some accounts give you a bonus rate if you meet certain conditions. Make sure to read the fine print to understand the requirements like minimum deposits and limited withdrawals needed to qualify for the bonus interest. You should also be reviewing the interest rate on a regular basis to make sure you are receiving the best deal.

Term deposits are another option. They guarantee a fixed interest rate if you agree to keep your money locked away for a specific period.

Government Bonds

Government bonds are usually more popular with conservative investors because they are generally safer. When you invest in government bonds, you lend money to the government and receive regular interest payments called coupon payments.

Bonds pay interest at regular intervals. If you hold them until they mature, you can count on a reliable return. Indexed bonds are especially useful when inflation is rising because they are designed to protect against inflation. You can buy and sell government bonds on platforms like the ASX.

Company Bonds

Company bonds are an alternative for those seeking a reliable income source. These bonds carry more risk than government bonds because if the company goes bankrupt, you could lose your investment. However, it’s important to note that bondholders usually get paid before shareholders if the company faces bankruptcy. This makes company bonds relatively less risky in such situations.

Beware of scams involving Treasury Bond offers. In December 2021, ASIC warned investors about several fake Treasury Bond offers that turned out to be scams. Keep in mind that financial institutions are not authorized to issue Treasury Bonds on behalf of the government. Make sure you speak with your financial adviser before proceeding with any of these options to ensure you make informed decisions.

Other Forms of Passive Income

Peer-to-Peer (P2P) Lending

P2P Lending is a modern and innovative way of borrowing and lending money that sidesteps traditional banks or financial institutions. Think of it as a matchmaking platform connecting borrowers who need loans with individual investors willing to lend money to earn interest. Through an online platform, borrowers can request a loan for various purposes, such as personal, business, or student loans, and investors can choose to fund those loans by lending a portion of the requested amount. Once the loan approval is granted, borrowers make regular payments, including interest, to repay the loan over a set period of time.

Investors earn interest on their investments, while borrowers often benefit from lower interest rates and more flexible terms than traditional lending options. Peer-to-peer lending allows individuals to interact and transact with each other directly, cutting out the middleman. For those willing to accept the risk, P2P has the potential to generate a good return. Nor does it require much effort because the platform does most of the administration and debt-chasing. However, investors must thoroughly research both the platform operator and the borrower’s creditworthiness. Therefore, talk to a financial adviser to ensure P2P is a suitable passive income investment strategy.

Royalties

If you have a creative talent, royalties offer an excellent source of passive income. For example, if you’re a musician, you can earn royalties every time your music is streamed or sold. Similarly, if you’re a writer, you can earn royalties on each copy of your book sold. Royalties can also come from other forms of intellectual property, such as patents, trademarks, and software. While earning royalties may require significant effort upfront to create and market your creative work, it can generate passive income for years to come.

How Financial Planning Can Help Increase Your Passive Income

Passive income can be a valuable addition to your income streams that helps you achieve financial independence. There are various ways to earn passive income, from traditional investments like rental properties and stocks to more creative options like starting a side hustle, royalties and online courses. However, it’s essential to carefully research and assess each option, consider the risks and expenses involved, and seek professional advice before investing your time and money. Yet, with careful planning and effort upfront, earning passive income is an excellent strategy to provide financial security, fight rising costs or live out your retirement stress-free.

Should you need specialised assistance with creating a passive income, Carbon’s team of financial planners and accountants are waiting to help. Get in touch with us today.