Tax depreciation is a complex and often misunderstood concept, especially when it comes to property. We’re here to uncover how tax depreciation works for investment properties and the advantages that it can provide for you at tax time.

Table of Contents

If you’re considering investing in property, don’t make the mistake of thinking that buying a property solely for tax benefits or depreciation is the way to go. These benefits are just outcomes of investing and shouldn’t be your primary motivation to invest. However, depreciation is part of the equation that can make it more compelling and attractive to purchase a property. Always be sure to run investment decisions (such as buying an investment property) past your accountant and/or financial adviser. If you don’t have one already, Carbon’s team of accountants, financial planners and finance brokers are available to help you with investing in your future and developing a wealth creation strategy for you.

For further reading on property investment principles, we have written helpful guides here:

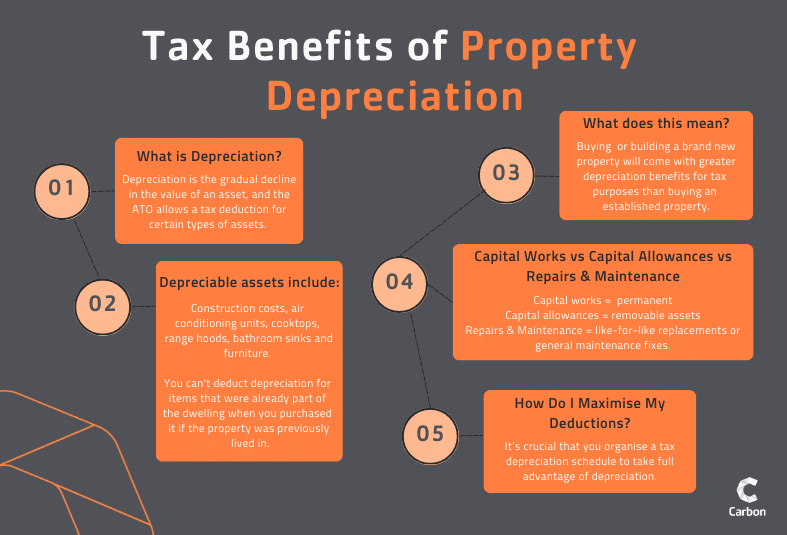

In simple terms, depreciation is the gradual decline in the value of an asset, and the ATO allows a tax deduction for certain types of assets. If we take a residential house as a rental/investment property, the assets that are depreciable include the construction costs (brickwork, roof covering, foundations), air conditioning units, cooktops, range hoods, bathroom sinks and furniture such as couches and tables (e.g., if you are leasing your property furnished).

This means that buying a new property or building brand new will come with greater depreciation benefits for tax purposes than buying an established property.

The ATO made a significant decision that if you buy a property after 1 July 2017, you cannot deduct depreciation for items that were already part of the dwelling when you purchased it if the property was previously lived in. Prior to this decision, you could get a depreciation report done when you purchased an established home and then deduct the depreciation of assets that came with the property, so bear this in mind.

This makes depreciation more substantial for new builds and hence a lot of investors gravitate towards buying a newly built property for investment. However, as mentioned above, always consult your financial adviser to ensure the property you’re buying is right for your specific circumstances.

This is a critical distinction and can catch a lot of investors off-guard.

As a rule of thumb, think of capital works as more permanent, capital allowances as removable assets and repairs and maintenance as like-for-like replacements or general maintenance fixes.

Capital works are your construction costs, capital allowances are for washing machines and desks and repairs and maintenance is repairing a damaged fence (needs to be the same fencing and not an upgraded fence) or fixing a hole in a gutter.

There are also differences in the rates of depreciation. Capital works are typically at a 2.5% depreciation deduction per year using the straight-line depreciation method (same fixed deduction each year), whereas capital allowances assets have different rates depending on their effective life (how long that asset is typically used for). The ATO effective life guide can be found here. The 2023 Federal Budget recently announced that they would be increasing the capital works tax deduction (depreciation) rate from 2.5 per cent to 4 per cent per year. For more information on this, read our Federal Budget Wrap Up blog here.

Repairs and maintenance are fully tax-deductible when they are incurred, so the good news is you don’t need to depreciate over a period longer than one year, you get the tax benefit straight away. Repairs and maintenance is an area that’s always under scrutiny by the ATO so make sure you check with your accountant every year whether your expense is actually a repair and not a new asset that needs to be depreciated.

When claiming capital works, the following guide from the ATO gives a checklist for the information you’re required to obtain and keep to be able to make a tax deduction.

It’s important to note that capital works and capital allowances interact with capital gains tax differently, which have impacts when you sell the property.

When you go to sell your property and are calculating your capital gain, the capital works deductions you have claimed along the way will need to be deducted from the cost base, meaning it will increase your capital gain or decrease your capital loss. In simpler terms, the tax advantages through the years you had been deducting will be ‘paid back’ when you sell the property.

Capital allowances however will not need to be reduced from the cost base, so you will get to ‘keep’ that benefit. This is the same for repairs and maintenance costs.

One of the main perks of depreciation expenses is that it is ‘non-cash’. This could mean you have a rental property that is ‘cash flow positive’ (cash inflows from rental income exceed cash outflows for rental expenses), however after deducting depreciation expenses (which do not require any cash to be paid throughout the year), the property can effectively make a net loss in the tax return (negatively geared), resulting in a tax refund.

It’s crucial that you organise a tax depreciation schedule to take full advantage of depreciation. A qualified quantity surveyor should conduct a physical inspection of the property and using their expert knowledge, will compile a full report that details all the separate assets and the allowable depreciation per year. It will also classify the assets correctly as capital works or capital allowances.

There are companies that provide excellent tax depreciation reports for investors. Some of these companies even send the report directly to your accountant to ensure that all important information is captured. We suggest that you speak to your accountant and they may be able to refer you to a trustworthy company that can provide this service.

It’s important to note that you can only claim depreciation for the period that the property was used as a rental (or available for rent). For example, if you move into the property for seven months, you cannot claim depreciation for that period and will need to adjust pro-rata for that financial year.

Understanding property depreciation can greatly benefit real estate investors in terms of tax savings but it’s a complex concept with many other technicalities and nuances. The great news is that your accountant can assist with any queries you have about tax depreciation. Contact our accounting team and we’ll help you get depreciation right for your investment property.

Healthy cash flow is essential for any business but it doesn’t always follow strong sales.…

Agribusinesses face a unique set of challenges, from unpredictable weather and rising input costs (like…

Cryptocurrency might be digital but your tax obligations around it are very real. Whether you’ve…

Carbon Group is excited to announce our first partnership of the 2025–26 financial year, welcoming…