If there’s one area of compliance that the ATO takes most seriously, it’s paying employees their super correctly, and on time. This is evident in the penalty and interest charges that the ATO levies on small businesses/owners that don’t get superannuation right, and it’s often more complex than you might think.

Our payroll specialists have created the following step-by-step guide to help you stay on top of your employee super obligations.

Table of Contents

Step 1: Identify whether you have an employee or contractor

The general rule of thumb is that superannuation applies to employees, not contractors. However, determining your workers’ status can be a grey area. Workers that are engaged on a contracting basis can still be classified as employees for the purposes of paying superannuation, especially if they only contract to your business and no others, or your business exerts control and influence over the worker.

The ATO has detailed resources to help you determine this:

- How to work out whether you have an employee or contractor

- The difference between employees and contractors

Step 2: How much super needs to be paid to employees

Employees’ super is paid at the rate of the Superannuation Guarantee (SG) which is currently 10.5% for the 2022-23 financial year, and this applies to Ordinary Time Earnings (OTE) for each employee, which includes their usual salary and wages and certain types of overtime, allowances, bonuses and leave payments.

Each pay item is fully explained by the ATO and can be viewed here.

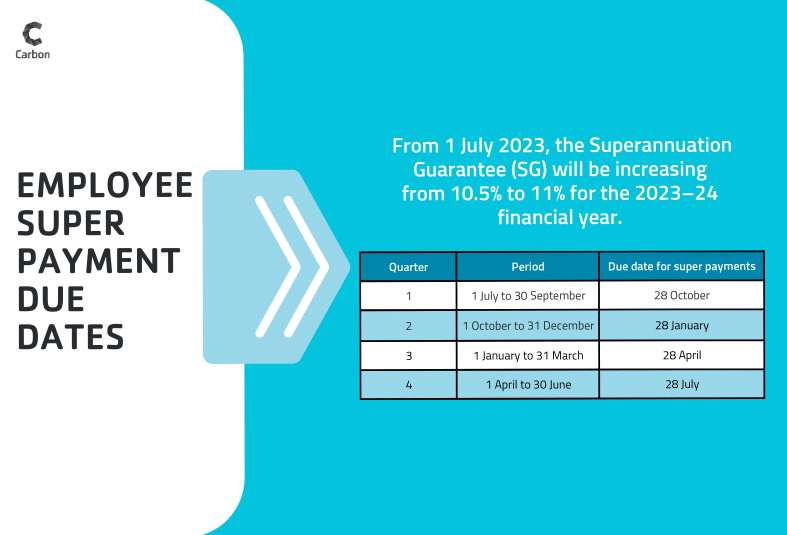

From 1 July 2023, the SG will be increasing from 10.5 to 11% for the 2023–24 financial year. The SG percentage rate will continue increasing by 0.5% every year until it reaches 12% from 1 July 2025.

Important tips:

- As of 1 July 2022, all employees (regardless of the amount they earn) are entitled to the superannuation guarantee. The previous $450 per month threshold no longer applies. For more information on this and other changes, see our post here.

- You must pay super guarantee on payments you make to an employee under 18 years old if they work for you more than 30 hours in a week, regardless of how much you pay them.

- The super guarantee only applies to the first $60,220 per quarter of an employee’s Ordinary Time Earnings. If an employee earns more than this per quarter, every $1 above $60,220 does not require super guarantee to be paid.

Step 3: When should super be paid to employees?

Super is required to be paid on a quarterly basis, by the 28th day of the month after the quarter ends (effectively you have 28 days after the quarter). For example, the quarter of 1st January – 31st March will be due 28th April. The table below shows each due date for each quarter, remembering that the payment needs to be received by your employees’ super fund by the due date, so best practice is to send payment at least 1-2 business days earlier.

| Quarter | Period | Due Date for super payments |

| 1 | 1 July to 30 September | 28 October |

| 2 | 1 October to 31 December | 28 January |

| 3 | 1 January to 31 March | 28 April |

| 4 | 1 April to 30 June | 28 July |

This is the case regardless of the pay cycles for your employees (weekly, fortnightly or monthly).

If you miss a payment, you’ll need to lodge a Superannuation Guarantee Charge (SGC) statement. This requires the late superannuation to be paid directly to the ATO along with penalties and interest and the whole amount becomes non-deductible for tax purposes, so it’s a significant burden if not paid on time.

Since timing is crucial, consider using cloud-based accounting software such as Xero to perform automatic super payments. As Xero platinum partners, our payroll specialists can help set you up as well as provide training and support for the best results using Xero.

Step 4: How to make a super payment

Super payments can now be made automatically through your accounting software via the superannuation clearing house which the ATO has set up specifically for small businesses. This is handy especially if you have a number of employees with different industry and retail super funds.

Ensuring your employees are set up correctly in your payroll system with their choice of fund, and pay items are set up correctly means making payment can be completed with a few clicks. If you need help with setting your employees up correctly, talk to our payroll experts today.

Super payments made easy with Carbon’s payroll specialists

Carbon’s payroll team are here to give you time back and take care of all your business’ super obligations, and ensure you stay compliant with the ATO. Get in touch with us and we’ll take care of the rest.