On 29 March, the 2022 Federal Budget was announced and with it came some new elements and reminders of upcoming changes. The Budget saw the removal of the $450 threshold amount for super contributions and a reminder that the super guarantee rate is increasing again – both from 1 July 2022. Our experts have provided a short summary of what these changes will entail for small businesses.

Removal of the $450 threshold amount for super contributions

Currently, if an employee earns less than $450 per month then their employer isn’t required to contribute to super for them. From 1 July 2022, everyone over the age of 18 will be paid super regardless of how much they earn and employees under 18 who work more than 30hours per week will be eligible for super.

Source: AFR

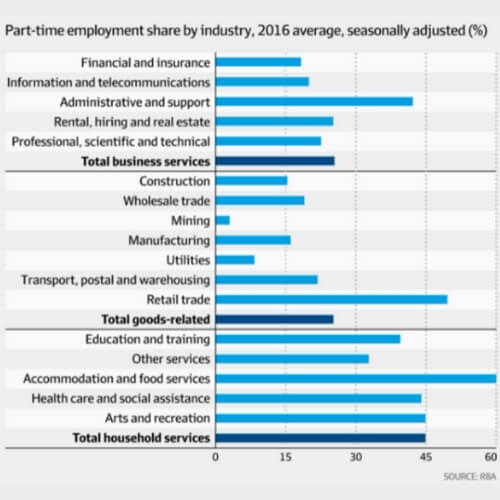

According to an article from The Financial Review, employers in the retail, accommodation and food services industry will be most affected, since they are more likely to employ workers who earn less than $450 a month.

The Government estimates that this will affect approximately 300,000 people and that most of these people are young workers employed part-time. 2

While using the STP (Single Touch Payroll) system is now mandatory for all Australian employers, there are still many small businesses not using it. For those businesses, the removal of the threshold could complicate the process of paying employees who only work short shifts. 1

Carbon’s team of payroll specialists can help you transition your business over to STP and meet your reporting responsibilities, so please get in touch if you need help.

Super Guarantee Rate Change

From 1 July 2022, the amount of super that business owners need to contribute for their employees (including yourself) increases from 10% of salary and wages to 10.5% of salary and wages.

As per the Federal Budget, the superannuation rate will continue to increase by 0.5% every year until it hits 12% in 2026. The increase to the super guarantee needs to be raised to 12% to meet the basic needs of Australian retirees in the future. 3

The staggered approach of increasing the super rate is needed to relieve cash flow stress from businesses. It gives them the chance to plan for the future without the pressure of time constraints. 3

What you need to do

Business owners will need to start preparing for these two changes to superannuation.

Be aware that if you have employees that make under $450 a month, you’ll need to investigate your cash flow management. Having transparency in your business financials and seeing where your money is coming and going is key to coping with these superannuation changes.

While it may seem like a very straightforward change, businesses should be checking that their payroll and accounting systems have been updated for super payments made after 1 July 2022. Whether you or your bookkeeper is putting in the information, make sure you have collected the correct client information from your employee, so the payments are made to the correct fund and don’t bounce back.

If you have the Statutory Rate option selected, the change to SG payments should be made automatically in your accounting system (like Xero or MYOB), however, if this option is not selected, you can review this in your Pay Template and manually update the rate if needed.

How Carbon can help

Our bookkeeping and payroll experts are here to help you manage your cash flow and ease the stress of having to update your accounting systems. It can be very time consuming going into each employee file and updating their super, which is why our team is on hand. Outsource what you can and focus on the tasks that you enjoy and grow your business. Get in touch with us today to get started.