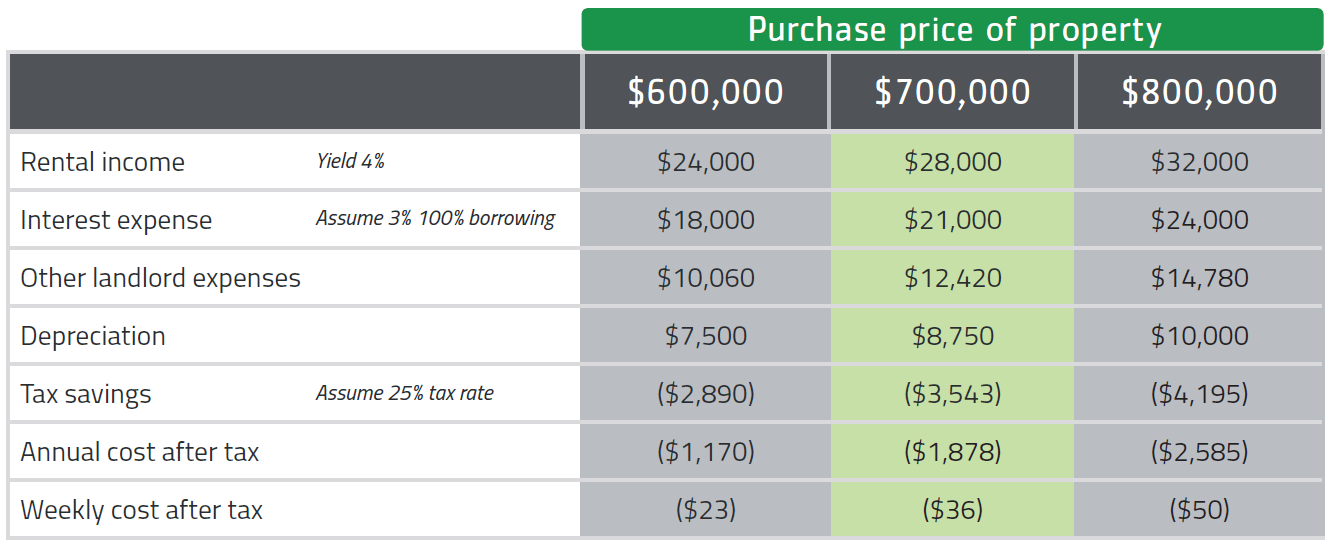

Recurring rates, fees and maintenance costs need to be balanced against projected rental income to determine whether a property will be positively or negatively geared.

Keeping on top of these costs by factoring them into your calculations is the key to successfully maximising your property investment portfolio, whilst minimising your personal stress levels.

NB: Figures quoted are estimates only. Assumes purchase of house and land and assumes an average tax rate of 25%.

Our services

- Rental analysis – we’ll review your personal financial position and advise on the costs and benefits of investing in property.

- Expert property advisors – we work with a panel of experts who can help you make an informed decision about buying the right property.

- Carbon Finance & Lending – our panel of experienced finance brokers can help you find and establish the ‘best fit’ loan for you.

Potential benefits of property investment

Building wealth – the right investments will increase in value over time, giving you more to cash in when the time is right.

Generate passive income – as your investments increase in value, they will continue to generate passive income which you will get to enjoy.

Retire sooner – with your investment portfolio growing in value, you could retire earlier or live more comfortably when you do.

Lifestyle benefits – you’ll have more to spend on the fun stuff with the growth of your investment value and passive income.

Minimise your tax – investments can legitimately reduce the amount of tax you pay, leaving more money in your pocket.

Want to know more?

Our experts are here to help you. Get in touch with us to get started.