Are you a business owner or manager in the hospitality industry? Then you know how crucial it is to stay informed about workers compensation. But with so much information out there, navigating the subject is challenging. That’s where our guide comes in. Whether you’re a seasoned pro or new to hospitality, our easy-to-follow guide will equip you and your team with the knowledge to stay up-to-date and compliant. So let’s get started.

Table of Contents

- What is Workers Compensation?

- Mandatory Legal Requirements

- Compensation Challenges Specific To The Hospitality Industry

- Common Workers Compensation Mistakes To Avoid

- Types Of Workers Compensation

- Is Workers Compensation Taxable?

- Is There GST On Workers Compensation Insurance Premiums?

- Have More Questions About Workers Compensation?

What is Workers Compensation?

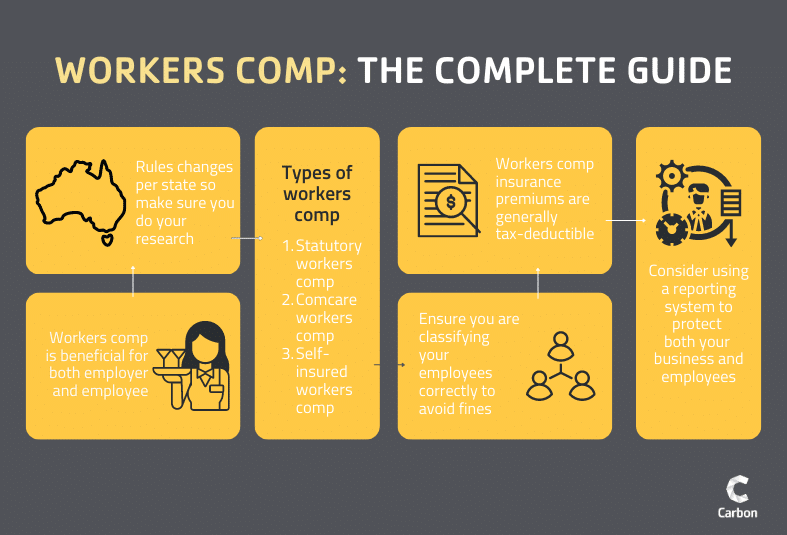

The hospitality industry is a bustling and dynamic field that employs millions worldwide. Unfortunately, workplace injuries happen in the blink of an eye, from slips and falls to burns and cuts. But did you know that workers compensation helps protect employees and employers?

Workers insurance programs provide essential benefits like medical expenses, rehabilitation costs, lost wages and compensation for permanent disabilities or death in case of work-related injuries or illnesses. For employers, workers compensation safeguards against lawsuits and financial losses from workplace accidents. So whether you’re a seasoned hospitality business veteran or just starting out, workers compensation is vital to keeping your team safe and your business protected.

Mandatory Legal Requirements

Did you know workers insurance is governed by the Workers Compensation Act (or similar legislation) in each state and territory? The name of the act may vary depending on where your business operates. For instance in Queensland, it’s known as the Workers Compensation and Rehabilitation Act while in Victoria it’s the Workplace Injury Rehabilitation and Compensation Act. Meanwhile, Western Australia has the Workers Compensation and Injury Management Act. Understanding the nuances of the act in your state is vital to ensuring you have the right coverage and meet your legal obligations as an employer.

Compensation Challenges Specific To The Hospitality Industry

With the hospitality industry’s high-pressure situations and physical demands, it’s crucial to have a solid plan in place to protect both your employees and your business. Here are some essential steps to help:

Stay On Top Of Your State’s Requirements

Each state has unique requirements for this insurance. Ensure you’re familiar with the rules and regulations in your state and that your business is fully compliant. Doing so protects your employees and safeguards you from fines and penalties.

The various Workers Compensation regulatory bodies and the ATO are also now undertaking data matching between payroll lodgements and ensuring the applicable entity paying the wages holds an applicable Workers Compensation policy. Fines and penalties apply if you don’t hold a valid cover while engaging employees.

Partner With An Insurance Broker Who Understands Your Industry

Choosing the right insurance broker is crucial. Look for an advisor with experience working with businesses in the hospitality industry, as they’ll better understand your unique risks and challenges. And as a result, they’ll help you choose the right coverage that fits your business’s specific needs.

Train Your Employees On Safety Protocols

Prevention is key and one of the best ways to avoid workplace injuries is to train your employees on safety protocols. Provide them with the necessary tools and knowledge to stay safe on the job including proper lifting techniques, safety equipment usage and handling hazardous materials.

Develop A Return-To-Work Program

In case of an employee injury, a return-to-work program is essential. These programs not only benefit the employee by providing a sense of purpose and normalcy but also reduce the cost of workers compensation claims for your business. Return-to-work programs should include light-duty work that accommodates the employee’s injury, with a plan to increase their workload as they recover gradually.

Keep Your Insurance Provider Informed

Communication is vital when it comes to workers compensation insurance. Stay in regular contact with your insurance broker and provider, and notify them of any changes to your business or workplace accidents. Open and transparent communication ensures you have up-to-date coverage and efficient processing in case of a claim.

Common Workers Compensation Mistakes To Avoid

There are some common mistakes many hospitality employers make regarding workers compensation insurance. Here are a few to avoid:

Misclassifying Employees

It’s important to classify your employees regarding workers compensation correctly. Misclassifying employees leads to fines, penalties, and legal trouble. Ensure you understand the difference between independent contractors, part-time employees, and full-time employees and that you classify your employees correctly.

Not Providing Adequate Training

Training your employees about safety protocols is crucial. Not providing adequate training increases the likelihood of workplace accidents and injuries which can be costly for you and your employees.

Failing To Report Accidents

As mentioned before, workplace accidents can happen in the blink of an eye. And when they do, it’s essential to report them immediately to your workers compensation insurance provider. Failure to do so may result in denied or delayed claims, placing a significant financial burden on your business and your employees. By having a system to report accidents and ensuring your employees are familiar with the injury reporting process, you can protect your business and provide your employees with the support they need in case of an injury. So don’t wait; report accidents promptly to ensure the best outcome for everyone involved.

Types Of Workers Compensation

Ensuring employee protection in case of a workplace injury or illness is crucial for any business in the hospitality industry. However, not all workers compensation coverage is created equal and it’s essential to understand the different types available.

Knowing the different types of workers compensation helps you make informed decisions about your insurance coverage and get the best value for your money. In Australia, there are three types of workers compensation:

1. Statutory

This type of workers compensation covers employees who are injured or become ill while performing their job duties. It provides wage replacement, medical benefits and lump-sum payments for permanent impairment or death.

2. Comcare

Comcare is a national workers compensation scheme that covers employees of the Commonwealth Government and some licensed corporations. It provides similar benefits to statutory workers compensation.

3. Self-Insured

Some large employers may choose to self-insure their workers compensation. Self-insuring means the employer takes on the financial risk of providing benefits to their employees in the event of a workplace injury or illness.

Is Workers Compensation Taxable?

Keeping costs down is a priority when running a hospitality business. Fortunately, workers compensation insurance premiums are generally tax-deductible. That means you can deduct your insurance costs from your taxable income and reduce the amount of taxes your business pays. But it’s important to note that the tax treatment of compensation insurance may vary depending on the type of coverage and nature of the claim.

For example, suppose you have a policy covering work-related and non-work-related injuries or illnesses. In that case, only the portion of the premium that covers work-related claims is tax-deductible. And if your workers compensation insurer reimburses your business for the costs of an injury or illness, you may need to include that reimbursement as taxable income.

Knowing the tax implications of your workers compensation insurance helps you make informed decisions about coverage and ensure you’re getting the most value for your money. So, be sure to consult with your accountant to understand the specifics of your business.

Is There GST On Workers Compensation Insurance Premiums?

Workers compensation insurance premiums do have Goods and Services Tax (GST) applied to them, even though the government charges no stamp duty on the standard coverage. Employers need to remember this because it affects the cost of the insurance that covers employees for work-related injuries or illnesses.

However, there can be stamp duty charged but only on extensions to the standard cover, such as principals indemnity, increased common law and the like.

For accurate information regarding the GST treatment of workers compensation insurance premiums and any potential exemptions or specific conditions that might apply, it’s advisable to consult with an insurance broker or accountant.

Have More Questions About Workers Compensation?

As a business owner in the hospitality industry, navigating workers compensation is often a daunting task. Still, ensuring employee protection is crucial in case of injury or illness. So don’t let common mistakes catch you off guard. Stay up-to-date with your state’s workers compensation requirements, work with a knowledgeable insurance advisor, train your employees on safety procedures, establish a return-to-work program and keep in touch with your insurance broker. And let’s not forget about the different types of workers compensation and their associated tax implications, which may help save you money.

With these measures in place, along with the help of a professional accountant and broker, you can create a safe and secure workplace for your employees while protecting your business from unnecessary financial losses. Get in touch with our team of insurance brokers and accountants today to ensure your premiums are up to date.