Did July 1st sneak up on you last financial year? Perhaps you’re already on top of your STP reporting and payroll tax lodgements. If not, this guide is for you.

Table of Contents

- What is Single Touch Payroll (STP)?

- What do I need to do for STP?

- What are the ATO’s reporting rules for STP?

- What are the reporting guidelines for STP?

- End-of-year finalisation through STP

- How payroll tax works in Australia

- What are the payroll tax thresholds?

- Need help with your payroll obligations?

- Payroll specialists in Australia

What is Single Touch Payroll (STP)?

Small businesses and employers must now report superannuation contributions, income tax withholdings and other payment information via a Single Touch Payroll (STP) system. This system replaced the traditional paper-based reporting process on July 1 2018 and makes it simpler to keep up with your end-of-year reporting requirements. STP removes the need to prepare and lodge paper-based payment summaries at the end of each financial year.

What do I need to do for STP?

If you’re a business owner, you must register with an STP provider and report your payroll information directly to the ATO after every pay run, regardless of how many employees you have. Doing so keeps you up-to-date with your tax obligations throughout the year. Most businesses use STP-enabled software like MYOB, Xero or a cloud-based payroll solution to submit their reports.

What are the ATO’s reporting rules for STP?

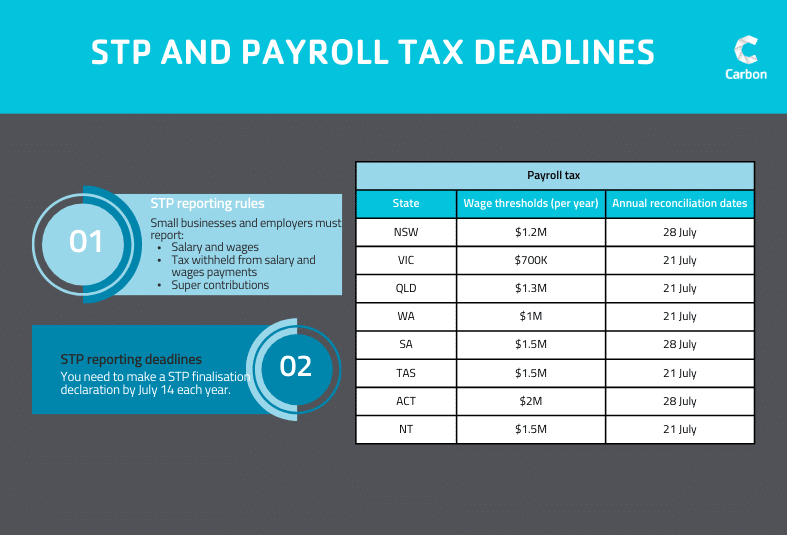

The ATO’s reporting rules for STP are simple: each pay period employers must report the following information to the ATO:

- Salary and wages

- Tax withheld from salary and wages payments, and

- Superannuation contributions.

You must also report other payment information such as allowances, bonuses and leave payments.

What are the reporting deadlines for STP?

The STP reporting deadline is usually the same as your payday. To comply you must have lodged all of the required information with the ATO by the day you pay your employees.

By 1 July, you should have lodged the final figures for the financial year that just ended. However, the ATO requires that data be reported within 14 days after payroll is processed. So 14 July is your absolute deadline. Failure to comply can result in penalties and other compliance issues.

Regularly check the ATO website for updates on reporting deadlines and changes to the STP requirements. Plus, keep an eye out for new software solutions that will simplify STP reporting and any news from your accounting or payroll provider about new features that may help with compliance. The ATO has also released a range of resources to help employers understand the requirements so ensure you’re using these as well.

And don’t forget your employees. Ensure they know what STP means and what they need to do to stay compliant. By doing so, you’ll be better placed to meet all of your STP obligations.

End-of-year finalisation through STP

As mentioned, you need to make a finalisation declaration by 14 July each year. However, if you can’t make a finalisation declaration by the due date, apply for a deferral to avoid possible fines. Even if you haven’t been using STP, you still have time to transition before 1 July. Seek help from your payroll or accounting provider for information about submitting the finalisation declaration.

How payroll tax works in Australia

In Australia, payroll tax is a state-based tax imposed on the wages paid by an employer to its employees. Not all businesses have to pay payroll tax. You pay when your total Australian wages are over the tax-free threshold for the relevant state or territory. Thresholds and tax rates vary between states and territories.

What are the payroll tax thresholds?

You need to register for payroll tax if your total Australian wages are more than the threshold. Check the threshold for each state or territory where you have employees.

As of 2022-2023 financial year, the payroll tax thresholds for each state and territory are as follows:

| State | Wage thresholds (per year) | Annual reconciliation dates |

| New South Wales | $1.2 million | 28 July |

| Victoria | $700,000 | 21 July |

| Queensland | $1.3 million | 21 July |

| Western Australia | $1 million | 21 July |

| South Australia | $1.5 million | 28 July |

| Tasmania | $1.5 million | 21 July |

| Australian Capital Territory | $2 million | 28 July |

| Northern Territory | $1.5 million | 21 July |

Employers in Australia must comply with legislation surrounding payroll rates and thresholds. Not doing so could result in a penalty or fine.

Need help with your payroll obligations?

As a business owner, it’s essential to understand your obligations regarding Single Touch Payroll and payroll tax lodgements. Moreover, complying with the reporting due dates and meeting your end-of-financial-year obligations is paramount to remaining compliant with the ATO and avoiding any possible fines.

You can simplify your business’s reporting processes while ensuring compliance with current laws and regulations by staying up-to-date with ATO regulations and utilising tools such as STP-enabled accounting systems. Additionally, an electronic system like STP can help eliminate errors caused by manual data entry or incorrect calculations while providing you with accurate summaries of employee payments at year’s end. Using STP can help make your payroll process more efficient and precise, allowing you to focus on other aspects of running your business.

Payroll specialists in Australia

If you need further assistance with streamlining your payroll processes or upgrading your Single Touch Payroll (STP) systems, talk to any one of our experienced payroll specialists near you in Melbourne, Adelaide, Sydney, Brisbane and Perth. We are here to help you understand your tax obligations and advise on the best way to manage payroll for your business. Call us on 1300 454 174 or fill out the contact form below.