Retirement is not a one-size-fits-all journey. It’s shaped by individual dreams and lifestyle choices. The key to a fulfilling retirement is planning but how do you begin to quantify your dreams into actionable financial goals? Whether you envision a modest lifestyle focusing on simple pleasures or a comfortable one with more leisure and luxuries, your choice sets the foundation for your savings goal.

Table of Contents

What Kind Of Retirement Lifestyle Are You Looking For?

First and foremost, ask yourself what kind of lifestyle you envision for your retirement. Do you see yourself living modestly, enjoying the simple pleasures of life? Or are you aiming for a comfortable lifestyle, with more room for leisure and luxury? This fundamental choice significantly impacts your retirement savings target.

Consider the Big Costs

- Medical Expenses: Trauma insurance provides a lump-sum payout upon the diagnosis of a covered critical illness. This immediate cash injection offers financial flexibility and peace of mind.

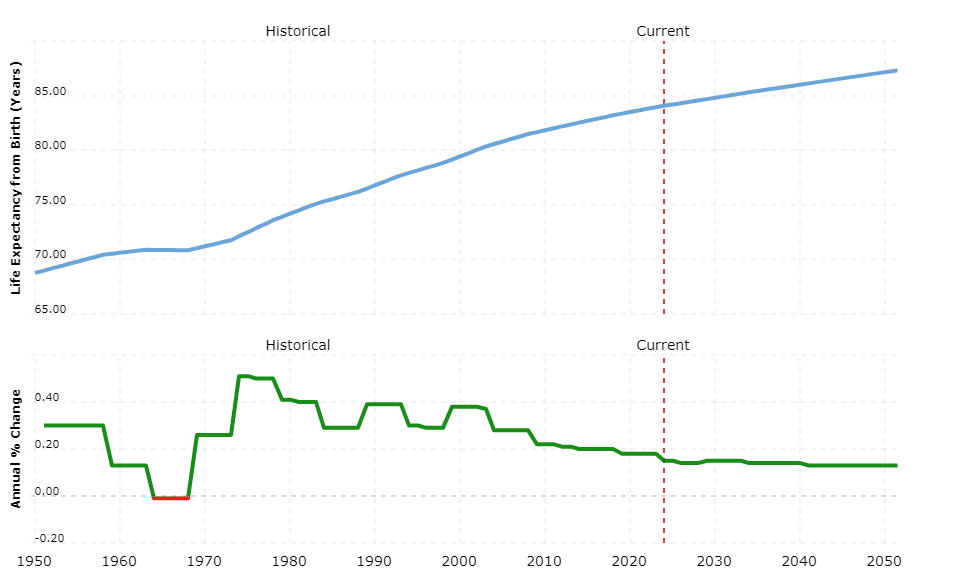

- Longevity: With increasing life expectancy, it’s essential to plan for a retirement that might last longer than that of previous generations. Ensuring your savings can support you for an extended period is key to a worry-free retirement.

- Diverse Income Streams: Relying solely on superannuation may not suffice. Look into other assets and investments that can contribute to your retirement income, providing you with financial stability and flexibility.

- Travel: For many, retirement is the time to explore and travel. Consider setting aside funds specifically for travel to ensure you can fulfil your wanderlust without compromising your financial security.

| Living Expenses | Age Pension | Modest Retirement | Comfortable Retirement |

| Travel | Limited to 1 short break or local day trips. | 1-2 short breaks near your home. | Annual domestic holiday & occasional overseas trip. |

| Groceries & Dining Out | Limited to grocery budget, discount meals or inexpensive takeaways. | Average range & quality of groceries. Infrequent dining out. | Good range and quality of groceries. Frequent dining out. |

| Leisure Activities | Low cost or no cost activities. Infrequent trips to the cinema. | Can partake in some paid leisure activities. | Able to regularly participate in paid leisure activities & cinema trips. |

| Car Ownership | Limited budget to own, maintain or repair a car. | Likely to own a cheap and older car, can afford basic level of repairs. | Able to afford / maintain a reasonable car and insurance. |

| Home Improvements | No budget for home maintenance and repairs. | Budget for home repairs but not improvements. | Can repair home include replace kitchen and bathroom over 20 years. |

| Clothing | Basic clothing. | Basic clothing. | Good clothing. |

| Alcohol | Limited. | Regular, mostly cheap casket wine or beer. | Regular, good wine and beer. |

| Personal Care | Less frequent haircuts & discount personal care. | Regular haircuts at basic salon. | Afford regular haircuts. |

| Home Applications | Less heating in winter / cooling in summer. | Not likely able to afford air conditioning. | A range of electronic appliances owned and used. |

| Health Insurance | No private health insurance. Public health system support only. | Basic private health insurance, limited gap payments. | Top level private health insurance, doctor/specialist visits, pharmacy needs. |

The three main retirement styles are: age pension, modest retirement and comfortable retirement.

Age Pension, Modest Retirement or Comfortable Retirement?

The Australian Superannuation Fund Association (ASFA) provides a useful benchmark by categorising retirement lifestyles into three types: Age Pension, Modest Retirement and Comfortable Retirement, with a notable annual difference of about $25,000 between modest and comfortable living standards.

Many retirees find they can live comfortably on about 67% of their pre-retirement income. This reduction is feasible as most have cleared their mortgages, no longer need to contribute to superannuation, and can benefit from senior discounts and tax-free super income. The age pension can also supplement this income, further reducing the need for a large retirement fund.

Diversifying your income streams through superannuation, investments, assets and the age pension is crucial for a stable financial foundation in retirement.

Setting Realistic Expectations For Your Retirement

Whether you’re in your energetic 20s or the more reflective 60s, understanding your current financial status concerning your retirement goals is crucial. With life expectancy increasing significantly since the 1970s, planning for a longer retirement is not just prudent—it’s essential.

It’s never too late to adjust your financial strategy to improve your retirement prospects. Consulting a financial advisor can help mitigate unnecessary risks and align your financial roadmap with your evolving goals and circumstances.

What Are You Currently Spending?

To set realistic retirement expectations, closely examine your current spending habits:

- Assess your everyday expenses, like groceries and dining out.

- Consider ongoing costs such as mortgages or rent, car maintenance and recreational activities.

- Factor in any family support you provide, as this could affect your retirement savings.

Inflation and Your Retirement Fund

Inflation can erode the purchasing power of your savings over time. It’s vital to factor in inflation when planning your retirement savings to ensure your fund retains its value in real terms.

How Much Super is Enough?

Key considerations for retirement planning include housing (ideally mortgage-free), aged care provisions, and potential medical or disability costs.

ASFA estimates that a comfortable retirement requires a super fund of $690,000 for couples or $595,000 for singles, assuming eligibility for a partial age pension. However, personalising your retirement plan using a retirement calculator can give you a more accurate picture based on your unique situation.

The sooner you start saving, the more you can leverage the power of compound interest, maximising your retirement funds.

Planning Your Dream Retirement

Retirement planning is a journey that demands vision, adaptability and a strategy that’s uniquely yours. Aligning your retirement dreams with your current financial realities—and considering the various factors that impact your savings—lays the groundwork for a plan that not only meets your needs but also fulfils your aspirations. Begin this critical journey today by taking the first step towards your ideal retirement future.

Wondering what your retirement could look like or when you might afford to embrace it fully? It’s about transforming uncertainty into a clear vision of your golden years. This isn’t just about whether you have enough; it’s about understanding when and how your retirement goals can become your reality. Let’s embark on this discovery together, aiming to provide you with the insight and confidence needed to plan a fulfilling retirement. Get in touch with our team today.