As a CFO, you can play a critical role in ensuring your company’s success by understanding how crowdfunding works and what types of campaigns are most likely to succeed. This blog post will explore everything you need to know about crowdfunding, from the different platforms available to tips for running a successful campaign. By the end, you’ll gain the knowledge you need to help your company secure the financing it needs to thrive.

Table of Contents

What is crowdfunding?

Whether you’re launching a new product, developing new technology or expanding the business, crowdfunding pools money and resources from many people, usually online, and utilises the funds for specific projects.

Typically, businesses looking for funding this way reach out to a vast pool of potential investors who previously may not have been accessible. The upshot is that companies can reach their financial goals without relying on traditional sources of finance such as banks, venture capitalists and angel investors. Ultimately, crowdfunding makes it easier for CFOs and business entrepreneurs to find the right investors and secure the funds they need.

Benefits of crowdfunding

Crowdfunding offers several advantages. For instance, quickly and efficiently reaching out to a large pool of potential investors, thus securing funds faster than traditional methods. Additionally:

- Businesses can use this opportunity to advertise and market their goods and services.

- Investors can be among the first to experience a groundbreaking product or service with early access, pre-order opportunities and unique rewards.

- Through pre-orders, businesses can determine the demand for their products or ideas in the early stages.

- Backers can voice their opinion and offer feedback to help shape the product or service. Plus, businesses can generate additional income through subscriptions from people who appreciate their work.

- Crowdfunding platforms allow businesses to access investments from anywhere in the world, with various payment options, including Bitcoin (but be careful of the possible tax implications!).

Types of crowdfunding

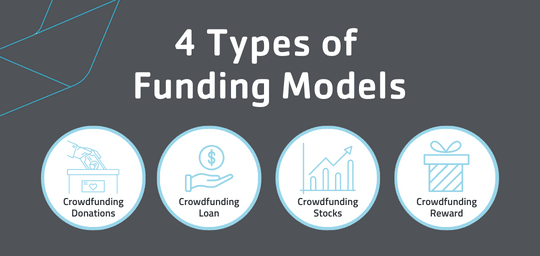

When raising crowd-sourced funds, it is essential to consider the types of crowdfunding because each has its advantages and disadvantages.

Source: 4 Types of Funding Models created by Carbon Group

Donation-based

Ideal for raising money for a charitable cause or project. Donors are not expecting any return on their investment but may receive rewards such as merchandise or recognition.

Reward-based

Best for raising funds for a product or service in exchange for rewards such as discounts, merchandise or access to the product or service.

Equity-based

Perfect for raising funds in exchange for equity in the company. Investors receive a share of the profits and may also have voting rights.

Debt-based

Great for raising funds in exchange for a loan with interest. The investor receives their money back with interest.

CFO or entrepreneur, it’s best to consider the advantages and disadvantages of each type of crowdfunding before selecting the best platform for your organisation’s needs.

How to ensure funding campaign success

A successful crowdfunding campaign relies on a reliable online funding platform, an effective marketing plan to attract and excite potential contributors, and meeting the Australian Tax Office’s (ATO) rules and regulations. See more on the ATO’s website.

Funding platforms

Not all funding platforms are equal. Consequently, different platforms have different rules and regulations regarding how long campaigns can last, what rewards are allowed and the necessary information to provide to potential investors. Additionally, some platforms may also require a specific amount of money to be raised before any funds are released. Other considerations include the following:

- Fees

Different platforms charge different fees for their services. It is essential to compare the costs of each funding platform and select the one that best suits your needs. - Reach

The more people exposed to your project, the better your chance of securing funding. Therefore, choosing a platform with broad appeal and reach is vital. - Credibility and security

Is the platform established, recognised and trusted? What about the platform’s security and reliability? What is the country of origin? - Accessibility

Are all devices (e.g. desktops, mobile phones, and tablets) able to access the site?

Choosing the best platform depends on your project and targeted financial outcomes.

Australia’s top 5 funding platforms

The top five most popular crowdfunding websites in Australia include:

Starting your research with these five and then speaking to a crowdfunding expert will ensure that you select the best platform for the best chance of success.

Successful crowd-sourced funding campaign

A successful crowd investing campaign requires an effective marketing plan to attract and excite potential contributors. The marketing plan should include:

- Identifying and clearly articulating the financial goals

- Crafting an impressive story

- Establishing a social media presence

- Creating a well-designed landing page on the funding platform

- Setting clear incentives for backers that encourage donations

- Targeting relevant audiences with the right message at the right time

- Setting achievable goals and timelines for each phase of the campaign, and

- Regularly providing communication updates.

Also, consider enlisting the help of influencers or industry veterans who can spread the word further. Last but certainly not least, don’t forget to make effective use of visuals in promotional materials; this will help capture more attention and retain the focus on your campaign message. Accordingly, your crowd funded campaign should:

- Set realistic goals

Setting a goal that is too high can discourage potential backers. - Offer rewards

Offering rewards such as discounts, or exclusive products can help to attract more backers. - Engage and inspire

Promote compelling campaign content on social media and other platforms to reach a wider audience and attract potential backers. - Connect with backers

Communicate with backers by responding to their questions and comments. - Monitor progress

Monitoring the campaign’s progress and adjusting goals ensures that the campaign is on track.

Managing all these components helps to increase the visibility of the project and attract more contributors for a greater chance of success.

Finally, as the CFO, you should ensure that you are aware of the risks associated with crowdfunding and take steps to mitigate these risks. This includes understanding the legal and regulatory requirements, monitoring progress, and engaging with backers.

The ATO and crowdfunding

As the CFO, you should ensure that you are aware of the risks associated with raising capital via crowdfunding platforms and take steps to mitigate these risks. In particular, the Australian Tax Office (ATO) has specific rules and regulations regarding crowdfunding that must be followed. It is important CFOs understand these rules and regulations to ensure that their funding campaigns are compliant. Additionally, CFOs should ensure that they are aware of any applicable taxes or fees associated with their crowdfunding campaigns. Some of the key rules and regulations include the following:

- All funds raised must be used for the purpose stated in the campaign

- Funds must not be used for personal gain

- All donations must be reported to the ATO

- Donors must be provided with a receipt for their donation, and

- Funds must not be used for illegal activities.

Understanding and following the ATO rules and regulations ensure that your campaigns are compliant with the ATO and successful.

General-purpose financial statements

When it comes to crowdfunding campaigns in Australia, most companies are not legally required to provide General Purpose Financial Statements (GPFS) to potential backers, but they are still required to prepare their financial statements in accordance with the Australian Accounting Standards (AAS).

However, providing GPFS can be a great way for companies to build trust and credibility with potential backers by giving them a comprehensive overview of the company’s financial performance. Additionally, GPFS can also demonstrate that the company is financially sound and capable of delivering on its promises. It’s important to note that companies may also be required to provide GPFS to the regulator or other authorities in certain circumstances, so it’s best to consult with an accountant to understand the specific requirements for your situation.

Furthermore, once crowdfunded funds have been raised, GPFS must be prepared for each successive financial period to ensure transparency and accountability for the use of the funds raised and to provide investors with accurate financial information.

Is crowdfunding the solution for you?

Overall, crowd sourced funding is an innovative solution for both businesses and individuals to raise money quickly and effectively. But as the CFO, ensure you understand the rules and regulations of raising crowd sourced capital set out by the ATO.

Additionally, give consideration to preparing GPFS. These statements are beneficial in providing potential backers with an understanding of the company’s financial position. That said, with the right amount of preparation, creativity and strategy in place, the associated benefits can far outweigh the risks. After all, fundraising success relies on having an engaged audience dedicated to your cause, thorough financial planning and an unbeatable marketing plan.

Lastly, crowd funded campaigns take time to research and setup. But with the support and advice from experienced accountants and financial advisers, you can increase your chances of success. So be bold in your funding vision and make your business idea a reality.

Are you looking for a virtual CFO?

As a business owner, you may be tempted to take on the role of your own CFO. However, the added stress and workload may not be worth it in the long run. Instead, consider the benefits of working with a virtual CFO.

Our experienced CFO Services team can provide a thorough review of your crowdfunding project and offer expert advice on how to set it up for success. With our support, you can focus on growing your business and pursuing your passion, rather than getting bogged down in financial details.

Don’t hesitate, book a consultation with us today and take the first step towards a more successful and stress-free crowdfunding effort. Just give us a call on 1300 454 174 or fill out the contact form below.