As a small business owner, understanding taxes and financial statements is crucial to managing your business finances and making informed decisions. By developing your financial literacy skills, you can ensure that you’re paying the right amount of taxes and using financial statements to guide your business strategy.

If you need additional help with your taxes or financial statements, consider seeking help from a tax accountant or bookkeeper, who specialise in these areas and are available to provide expert guidance and support.

In this blog post, we’ll provide an overview of taxes and financial statements and offer tips on how to read and understand them so that you can confidently manage your business finances.

Table of Contents

Understanding Taxes

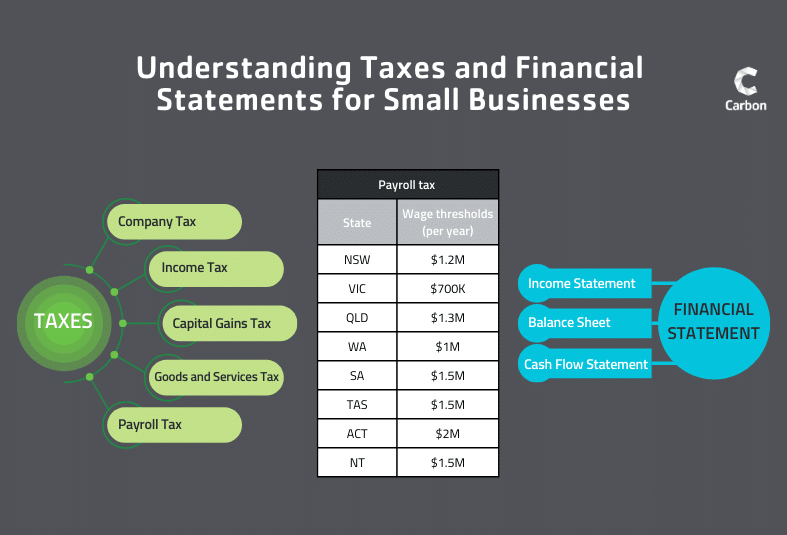

As a small business owner in Australia, you have several different types of taxes to be aware of including company tax, income tax, capital gains tax, goods and services tax and payroll tax. These taxes are administered and collected by the Australian Taxation Office (ATO) and in some cases state government revenue offices.

By understanding your taxes, paying the correct amount on time and taking advantage of any tax concessions available to you, you can save money and grow your business.

Company Tax

An Australian-resident company is subject to company tax at a rate set by the Federal Government. A non-resident company is taxed on its Australian source income at the same rate as a resident company. The taxable income and tax rate may vary depending on industry and business structure.

For more information on company tax including the rates, visit the ATO’s website.

Income Tax

Income tax applies to businesses that operate under a trust in Australia. For tax purposes, a trust is considered a separate entity and therefore is required to lodge its own tax return and pay tax on the income it earns. The trust’s income is distributed to the beneficiaries according to the terms of the trust deed and the beneficiaries are then liable to pay tax on their share of the trust’s income. More information on this can be found here.

Capital Gains Tax (CGT)

Capital Gains Tax (CGT) is the tax you pay on profits from selling assets such as property. You report capital gains and losses in your income tax return and pay tax on your capital gains. Although it is referred to as ‘capital gains tax,’ it’s part of your income tax and not a separate tax.

Foreign entities may be subject to CGT on assets acquired and used in carrying on a business in Australia. Businesses are required to keep records upon acquiring assets that may be subject to CGT in the future. Small businesses may also be eligible for CGT concessions under certain circumstances. See more about CGT here.

Goods and Services Tax

Goods and Services Tax (GST) is a broad-based tax of 10% on most goods, services and other items sold or consumed in Australia. Most businesses are required to register for GST with the ATO. Businesses that have paid for business supplies inclusive of GST are entitled to claim an equivalent input tax credit. Certain businesses may also be eligible for GST concessions. Read more about GST here.

Payroll Tax

In Australia, payroll tax is a state-based tax imposed on the wages paid by an employer to its employees. Not all businesses have to pay payroll tax. You pay when your total Australian wages are over the tax-free threshold for the relevant state or territory. Thresholds and tax rates vary between states and territories.

As of 2022-2023 financial year, the payroll tax thresholds for each state and territory are as follows:

| State | Wage thresholds (per year) |

| New South Wales | $1.2 million |

| Victoria | $700,000 |

| Queensland | $1.3 million |

| Western Australia | $1 million |

| South Australia | $1.5 million |

| Tasmania | $1.5 million |

| Australian Capital Territory | $2 million |

| Northern Territory | $1.5 million |

Reading And Understanding Financial Statements

Financial statements provide a snapshot of your business’ financial health. There are three main sections of a financial statement:

- Income Statement

- Balance Sheet

- Cash Flow Statement

Income Statement

The income statement shows your business’ revenue, expenses and net income or loss for a specific period of time (e.g., month, quarter or annual). This statement helps you understand how much money your business is making and where your money is going.

Balance Sheet

The balance sheet shows your business’ assets, liabilities and equity at a specific point in time. This statement helps you understand your business’ financial position and how much it’s worth.

Cash Flow Statement

The cash flow statement shows your business’ cash inflows and outflows for a specific period of time. This statement helps you understand how much cash your business has on hand and how it’s being used. Here are a few reasons why cash flow reporting is helpful for businesses:

- Cash flow reporting provides insight into your business’ financial health. You can use this information to identify trends and patterns in your cash flow and to make strategic decisions about your business finances.

- By analysing your cash flow statement you can gain a better understanding of your business’ financial needs and plan accordingly such as cutting expenses or seeking additional funding.

- By understanding your cash flow patterns you can create a more accurate forecast and budget that reflects your business’ actual cash needs.

- When you understand your business cash flow you can make informed decisions about investing in new projects, assets or initiatives.

General Purpose Financial Statements

In addition to the three main sections of a financial statement, there are also General Purpose Financial Statements (GPFS) that supply a high-level overview of a business’ financial performance.

These statements which include the income statement, balance sheet and cash flow statement can be used by investors, creditors and other stakeholders to evaluate a business’ financial health and potential for growth. By presenting a clear and concise summary of a business’ financial information, GPFS can help attract investment and secure financing, both of which are critical for businesses looking to grow and expand their operations.

Virtual CFOs (who provide financial expertise on a virtual, part-time or project basis) can help businesses prepare accurate and timely GPFS. This service can be particularly valuable for small and medium businesses that may not have the resources to hire a full-time CFO. By outsourcing financial statement preparation to virtual CFOs, businesses can ensure that their financial information is accurate, up-to-date and presented in a way that’s easily understood by stakeholders.

Develop Your Financial Literacy Skills

To read and interpret your taxes and financial statements, you’ll need to understand key financial terms such as revenue, expenses, profit and cash flow. Developing basic financial literacy skills is essential for any small business owner. By understanding your taxes and financial statements, you can make informed decisions about your business finances and set your business up for long-term success. Remember to stay organised, seek out professional advice from financial experts and continue to educate yourself about financial topics relevant to your business.

Grow Your Business With Expert Accountants And Bookkeepers

It’s important for small business owners to have a solid understanding of financial terms such as revenue, expenses, profit and cash flow to properly read and interpret their taxes and financial statements. Having basic financial literacy skills can help you make informed decisions about your business finances which is essential for long-term success.

Staying organised, seeking professional advice from financial experts and continuing to educate yourself about financial topics relevant to your business are all important steps to take. If you are needing help, our team of accountants, bookkeepers, payroll specialists and virtual CFOs are here to assist you. Get in touch with us today.