With the deadline fast approaching (1 May 2023), here’s everything you need to know about the R&D Tax Incentive.

Table of Contents

- About the R&D Tax Incentive

- What is the eligibility criteria of the R&D Tax Incentive?

- What makes the R&D Tax Incentive different to other grants in Australia?

- How do I apply for the R&D Tax Incentive?

- When is the next R&D claim due?

- What are the benefits of working with an R&D expert?

- Ready to lodge your R&D claim?

About the R&D Tax Incentive

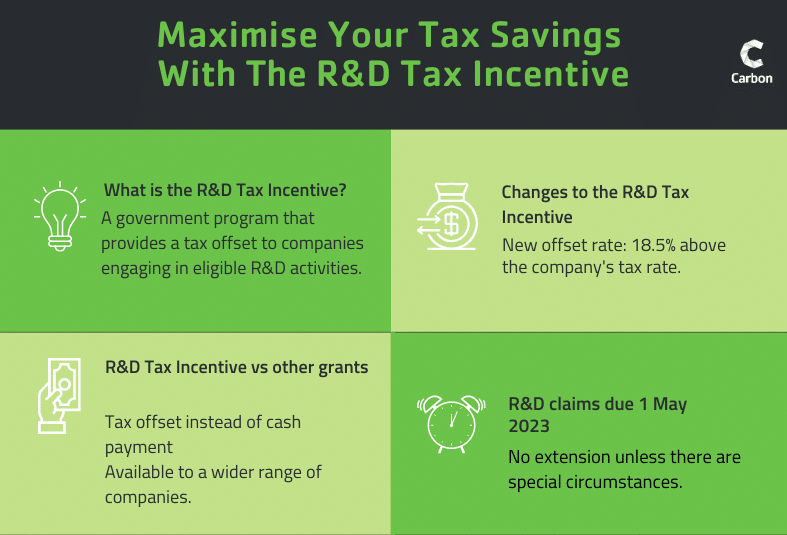

The R&D Tax Incentive is highly desirable for companies that have already invested or are looking to invest in research and development activities. This federal government program is designed to encourage innovation by providing a tax offset to companies that engage in eligible R&D activities.

What is the eligibility criteria of the R&D Tax Incentive?

The R&D Tax Incentive program underwent significant changes in 2020, which became effective for financial years starting on or after July 1, 2021. The previous 43.5% refundable offset rate was replaced with a new offset rate of 18.5% above the company’s tax rate, and the flat 38.5% non-refundable rate was substituted with a progressive, tiered R&D intensity threshold. This new tiered system provides increased tax offset benefits to companies that invest more heavily in R&D activities, providing a more generous reward for innovation. To be eligible for the R&D Tax Incentive, companies must operate in Australia and engage in eligible R&D activities, such as creating new knowledge or improving existing knowledge.

What makes the R&D Tax Incentive different to other grants in Australia?

The R&D Tax Incentive program is widely used by companies in Australia and has been successful in supporting innovation and growth. Compared to other government grants and funding options, the main benefit of the R&D Tax Incentive is that it provides a tax offset, which can provide a cash benefit for companies in a tax-loss position. The program is also available to a wider range of companies compared to other grants and funding options.

How do I apply for the R&D Tax Incentive?

The process of applying for the R&D Tax Incentive involves submitting a claim to AusIndustry outlining your eligible R&D activities. AusIndustry provides guidance to help companies make a successful claim, but it’s always wise to seek professional help from a registered tax agent or adviser with experience in the R&D Tax Incentive.

When is the next R&D claim due?

Don’t wait till the last minute, companies have until 1 May 2023 to submit their claims for the current year’s R&D Tax Incentive. And remember, this deadline is not something you can “snooze”. Unless there are extenuating circumstances, there’s no extension, so get those claims in on time!

What are the benefits of working with an R&D expert?

At Carbon Group, we offer a range of services to assist companies in making a successful claim for the R&D Tax Incentive program in Australia. These services include:

- Reviewing the company’s business activities to identify any eligible R&D activities.

- Reviewing internal documentation to ensure it can be used to substantiate the claim.

- Preparing R&D project documentation to provide detailed information about the activities and expenses that are being claimed.

- Assisting with the registration process by preparing and lodging the Application for Registration.

- Calculating eligible R&D expenditure to ensure that the claim is for the maximum amount possible.

- Preparing the ATO R&D Tax Schedule, which is the document that is sent to the ATO as part of the claim.

- Responding to requests for information from the ATO or AusIndustry, if necessary.

By working with an R&D tax expert, you’re ensuring your claim is complete and accurate, maximising the value of your tax offset.

So, are you ready to lodge your R&D claim?

The R&D Tax Incentive is a great benefit for companies who invest in research and development activities. Don’t miss out on this opportunity to reduce your tax liability and drive innovation in Australia. Get those claims in before the deadline and consider working with an R&D tax expert in Brisbane, Melbourne, Adelaide, Perth or Sydney to ensure your claim is submitted correctly.