For many small and medium-sized businesses in Australia, investing in new assets and equipment can be a significant financial burden. However, thanks to the Temporary Full Expensing (TFE) scheme, eligible businesses can now claim an immediate tax deduction for certain assets.

Table of Contents

- What is the Instant Asset Write Off (IAWO)?

- What is Temporary Full Expensing (TFE)?

- Eligible assets and entities under TFE

- What are the benefits of TFE for my business?

- Asset Finance

- Tax Planning and Tax Return Lodgment

- What happens after 30 June 2023?

- Grow your business with Temporary Full Expensing

What is the Instant Asset Write Off (IAWO)?

The Instant Asset Write Off (IAWO) scheme, introduced by the Australian Government, allows eligible businesses to immediately claim a tax deduction for the full cost of certain depreciating assets.

Previously, the eligible cost of an asset had to be under $150,000 but in October 2022, the government announced that due to the economic implications of COVID-19, the threshold would be removed. While this was set to expire on 30 June 2022, the 2021-22 Federal Budget announced an extension until 30 June 2023. This extension is called Temporary Full Expensing (TFE).

What is Temporary Full Expensing (TFE)?

Due to the success of IAWO, the government introduced the Temporary Full Expensing (TFE) scheme which serves as a limitless extension of the original incentive.

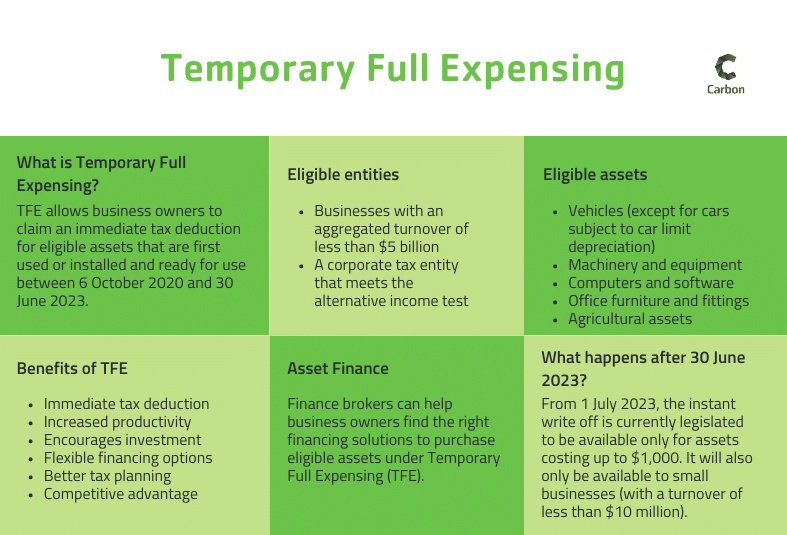

TFE allows business owners to claim an immediate tax deduction for eligible assets that are first used or installed and ready for use between 6 October 2020 and 30 June 2023. Businesses will also be able to deduct the full cost of improvements to these assets and to existing eligible depreciating assets made during this period.

Eligible entities and assets under TFE

For businesses considering upgrading their equipment or buying a new business car, making the most of TFE is a smart business move, helping to fuel the growth of your business.

Eligible entities

You may be eligible for TFE if you are one of the following:

- Businesses with an aggregated turnover of less than $5 billion

- A corporate tax entity that meets the alternative income test.

Eligible assets

TFE is available for assets that are first used or installed and ready for use between 6 October 2020 and 30 June 2023. It applies to most new or second-hand depreciating assets including:

- Vehicles (except for cars subject to car limit depreciation)

- Machinery and equipment

- Computers and software

- Office furniture and fittings

- Agricultural assets

Consider the below example for a construction company

- On 1 October 2022, the business purchases a work truck for $160,000. The business can claim the entire amount as a deduction under TFE.

- In December 2022, the business constructs a customer reception lounge at its office for $50,000. Because the expenditure is on capital works, the business can’t claim a deduction under TFE (it will be subject to a claim under Division 43 instead over 40 years).

- On 18 February 2023, the construction business incurs $10,000 in costs while improving an existing depreciating business asset. The business can claim a deduction for these costs under TFE.

- On 21 March 2023, it purchases a work vehicle (SUV) for $65,000 which will be used solely for business use. This asset is eligible for TFE, but the deduction will be subject to the car limit ($59,136 in the 2020-21 income year). The excess is not available as a tax deduction. This contrasts with the earlier example where a $160,000 truck was purchased. Such a vehicle is not a car for depreciation purposes and therefore a full deduction can be claimed because it is not subject to the car limit.

- At the end of the 2022-23 income year, the business had a balance in its small business pool of $100,000. The business will deduct the balance of the pool under TFE.

To find out more about the eligibility for TFE, head to the ATO’s website.

Wondering what other tax deductions tradies can claim? Read our blog here.

What are the benefits of TFE for my business?

Temporary Full Expensing supports businesses by encouraging growth and investment. Benefits of Temporary Full Expensing for businesses include:

Immediate tax deduction

By claiming an immediate tax deduction for the cost of eligible assets, you can reduce your taxable income and your tax liability in the same financial year. This can provide a cash flow boost, allowing businesses to invest in new equipment or assets sooner than planned.

Increased productivity

Investing in new or upgraded assets can increase your business’ productivity, efficiency and competitiveness. This can help you to expand your operations, create jobs and generate more revenue.

Encourages investment

By providing incentives for businesses to upgrade their equipment or invest in new technology, the scheme helps to create a more modern and efficient business environment.

Flexible financing options

The scheme is available to a wide range of businesses across various industries providing flexibility in terms of what assets can be claimed and how they can be used. This can be especially beneficial for small businesses that may have limited resources or cash flow.

By working with a finance broker, you can access various financing options to purchase eligible assets including leasing, hire purchase and unsecured loans. This can help spread the cost of an investment over time and preserve your working capital.

Better tax planning

By working with a tax accountant, you can plan your investments and claim the maximum tax deductions available. You can also ensure that you comply with the ATO’s record-keeping and reporting requirements.

Competitive advantage

By investing in new assets, businesses can gain a competitive advantage over their competitors, enabling them to deliver higher-quality products or services or operate more efficiently. This can be especially important for small businesses looking to expand their customer base.

Asset Finance

Finance brokers can help business owners find the right financing solutions to purchase eligible assets under Temporary Full Expensing (TFE).

Ultimately, the assistance of finance brokers can be critical for businesses to take advantage of TFE and invest in the assets they need to grow and succeed. Finance brokers can:

- Assess your financial position and borrowing capacity.

- Provide you with a range of financing options from different lenders.

- Negotiate the terms and conditions of your finance agreement.

- Help you to secure the financing you need to purchase eligible assets.

- Advise you on the tax implications of your financing arrangements.

Ultimately, the assistance of finance brokers can be critical for businesses to take advantage of TFE and invest in the assets they need to grow and succeed.

Tax Planning and Tax Return Lodgment

Tax planning is essential if you’re wanting to maximise the benefits of the Temporary Full Expensing scheme. A tax accountant can help you understand the eligibility requirements, identify eligible assets and plan your purchases to ensure you can claim the deduction. They can also help you with tax planning strategies such as prepaying expenses or deferring income to optimise your tax position.

When it comes time to file your tax return, a tax accountant can help you accurately report your eligible assets and claim the temporary full expensing deduction. They can ensure you comply with all tax laws and regulations and help you avoid any penalties or fines.

What happens after 30 June 2023?

It’s important to note that any assets purchased must either be in use or installed and ready for use by 30 June 2023 to qualify for Temporary Full Expensing. If the assets have been ordered and paid for but haven’t arrived (or aren’t being used), the instant deduction cannot be claimed on them.

From 1 July 2023, the instant write off is currently legislated to be available only for assets costing up to $1,000. It will also only be available to small businesses (with a turnover of less than $10 million). This means that businesses must take advantage of TFE in the next few months and stay tuned for more announcements from the government.

Grow your business with Temporary Full Expensing

In conclusion, Temporary Full Expensing provides a valuable opportunity for small and medium businesses to invest in their future and reduce their tax burden.

Looking to purchase new assets or upgrade existing ones? Need help securing finance or want to minimise your tax burden? Our team of finance brokers and tax accountants are here to help. Get in touch with our team today.