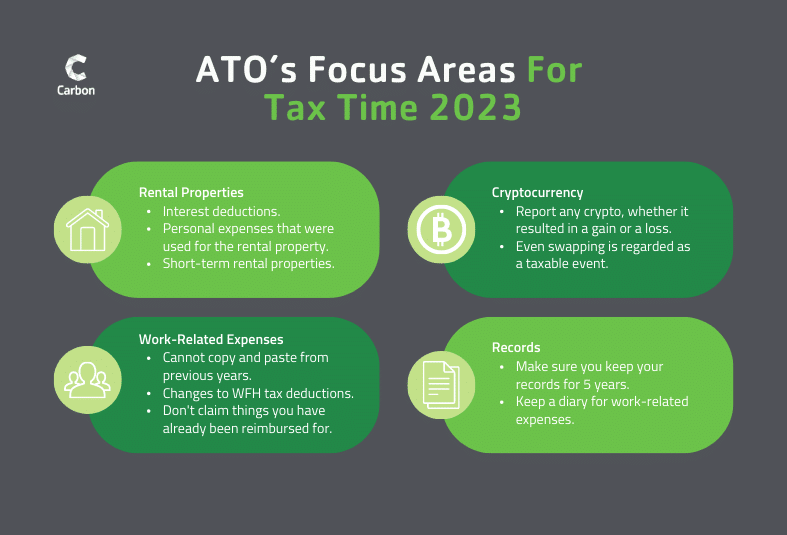

As tax season approaches, it’s essential to stay updated on the Australian Taxation Office’s (ATO) focus areas for the year. The ATO has outlined four key focus areas and understanding and being prepared will help you when the time comes to lodge your individual tax return. In this article, Carbon’s Accounting & Tax Partner, Michelle Maynard dives into the ATO’s focus areas and provides valuable insights to ensure you’re well-prepared for tax time.

Table of Contents

Rental Properties

For investors with rental properties, the ATO has announced that they will be closely examining your tax returns this year. One area of particular concern for rental property owners when it comes to tax returns is the treatment of interest deductions. The ATO emphasises the importance of only claiming interest expenses directly associated with the portion of the loan used for purchasing the rental property. It’s important to note that any additional borrowing for personal purposes such as home renovations or vacations, cannot be claimed as interest deductions.

The ATO will also be looking at personal expenses that individuals may inadvertently include in their rental property tax returns. These expenses include repairs, maintenance or purchases related to the property such as those made at Bunnings. To ensure compliance, it’s essential to maintain detailed receipts and only claim deductions that are directly applicable to your rental property.

Lastly, for owners of short-term rental properties, the ATO is paying close attention to ensure that deductions are not claimed for periods when the property was used personally or rented out at a discounted rate to family and friends. To avoid any issues, it’s crucial to maintain accurate records, claim deductions exclusively related to the rental property and adhere to the guidelines set by the ATO.

Cryptocurrency

Has anybody dabbled in cryptocurrency this financial year?

It’s important to recognise that when it comes to cryptocurrency and the possible tax implications, the ATO is probably already well aware of these transactions. In fact, your accountant will receive a warning when preparing your tax return, indicating that you possibly bought or sold crypto. So, what does this mean for your tax return?

To better understand the tax treatment of cryptocurrency, it’s helpful if you view it as a type of share. The ATO definitely considers crypto assets in a similar way. So, if you have sold any cryptocurrency, whether it resulted in a gain or a loss, it’s essential to declare that income in your tax return. Even swapping one cryptocurrency for another is regarded as a taxable event in the ATO’s eyes.

Make sure you’re accurately reporting any gains or losses, maintaining thorough records and ensuring compliance when filing your tax return for the 2022-2023 financial year. By following these guidelines, you can effectively navigate the tax implications associated with cryptocurrency transactions.

Work-Related Expenses

Individuals claiming work-related deductions should be aware of the ATO’s increased focus in this area. Firstly, it’s important that you don’t just ‘copy and paste’ generic deductions from previous years. The ATO is specifically targeting individuals who do this. Secondly, make sure that you have not been reimbursed by your employer for any expenses you plan to claim as deductions and have kept records of every deduction you’re wanting to claim.

The ATO also recently announced changes to working-from-home tax deductions. Previously, you could use the cents-per-rate method, which included 52 cents per hour, along with a portion of your internet and mobile phone expenses. However, since 1 March 2023, you now need to keep a record of every single hour worked, allowing you to claim a higher rate of 67 cents per hour. It’s important to note that this higher rate is all-encompassing, meaning you cannot claim additional portions for internet or mobile phone expenses separately. The 67-cent rate covers all associated costs.

Alternatively, there is an actual method available, enabling you to claim a portion of various expenses such as internet, home phone, mobile and electricity. However, the ATO has strict requirements for determining these amounts. You must keep copies of records that detail the hours worked and the frequency of device usage. This can be a tiresome process but regardless of the method you choose, it’s important to keep a diary that accurately records all hours worked from home.

The ATO places significant emphasis on working-from-home deductions and suspects they lose approximately $7 billion annually due to overclaims in this area. So for this very reason, it’s crucial to keep proper records, ensure you have not been reimbursed for expenses and genuinely incurred the claimed expenses.

Importance of Records

The final area the ATO has announced they will be focusing on this tax season is the records. They have emphasised the importance of maintaining accurate records for all claimed deductions. Your records must be kept for up to five years from the date of lodging the tax return, as the ATO reserves the right to request them at any time. Credit card and bank statements alone are insufficient. Original invoices are essential to substantiate expenses claimed in your tax return. Digital copies or scanned documents are acceptable as long as they provide evidence of where the money was spent, what it was spent on, and when the expenditure occurred.

Stay Compliant By Working With A Chartered Accountant

As tax time approaches, being aware of the ATO’s focus areas for 2022-2023 is crucial to ensure compliance and accurate tax returns. If you have questions about what you can and can’t claim or the lodging process, our Chartered Accountants are here to help. Their expertise and up-to-date knowledge of tax laws and regulations can help ensure compliance and maximise deductions within the boundaries of the law. Get in touch with us to talk more about your individual tax return.

Read more about individual tax returns:

- Individual Tax Returns

- A Step-by-step Guide To Lodging An Individual Tax Return

- What if I made a mistake on my individual tax return?

- Be prepared: Your individual tax return checklist