From changes to superannuation taxes to updates on working-from-home tax deductions, these announcements from the Federal Government and Australian Taxation Office (ATO) are worth paying attention to. Our accountants break down the latest news and provide insights into what these changes mean for you.

Table of Contents

Changes to superannuation taxes

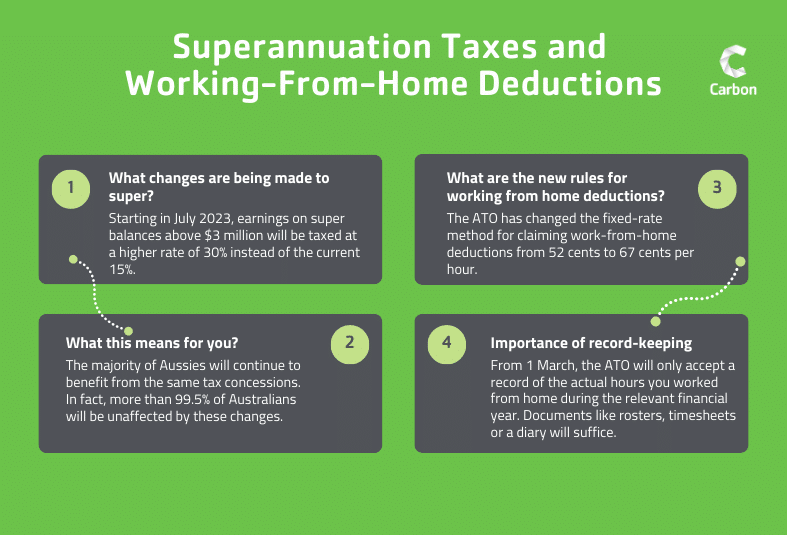

On 27 February, the Federal Government announced that starting in July 2025, earnings on super balances above $3 million will be taxed at a higher rate of 30% instead of the current 15%.

Treasury data shows that the 15% increase in taxes on investment earnings will affect approximately 80,000 Australians, which equates to only 0.5% of savers who possess significant, multimillion-dollar super balances.

To avoid the debate about broken election promises, the Federal Government stated that it had no plans to alter the superannuation system until after the next election in the first half of 2025.

Prime Minister Anthony Albanese has said that despite the changes to the superannuation system, the majority of Australians will continue to benefit from the same tax concessions that help them to save more for their retirement. In fact, he says that more than 99.5% of Australians should not be affected by these changes.

The changes to super were suggested to ensure that high-income earners were paying their fair share of taxes while still encouraging Australians to save for their retirement. Read more from the press conference here.

Changes to working-from-home tax deductions

The Australian Taxation Office (ATO) has announced changes to working-from-home tax deductions. There are two methods for claiming working-from-home deductions: the actual cost method and the fixed rate method.

The fixed-rate method is the one that’s changing this year, with the amount you can claim for each hour you work from home increasing from 52 cents to 67 cents.

What expenses does it cover?

This method now covers additional expenses, including:

- Home and mobile internet or data

- Home and mobile phone usage

- Gas and electricity for heating, cooling and lighting

- Stationery and computer consumables, like printer paper and ink

If you use the fixed rate method to calculate your working-from-home expenses, you can’t claim a separate, additional deduction for any of the items it covers.

Items costing less than $300 can be immediately claimed, but for more expensive items, only the decline in value over its lifetime can be claimed.

You can also claim any costs you incur for the repairs and maintenance of the items. If you use the item for both professional and personal purposes, you can only claim the work-related portion as a deduction. In special circumstances, taxpayers with a dedicated home office may also be able to claim occupancy expenses such as mortgage interest or rent, or cleaning expenses.

What records do you need to keep?

From 1 March, the ATO will only accept a record of the actual hours you worked from home during the relevant financial year. Documents like rosters, timesheets, or a diary will suffice. You also need to keep records of each expense you incur. This means if you use your phone when working from home, you’ll need to have a copy of your bill on hand. The same goes for electricity, gas, and internet, as well as any furniture or technology you use. Read more on the ATO’s website.

How do these changes impact you?

Carbon’s Accounting & Tax Partner, Michelle Maynard, recently sat down with Channel 9 to discuss the changes to superannuation taxes and working-from-home tax deductions, and what this means for Australians. For more information, watch the segment below.

Our tax accountants are always up-to-date with the latest tax changes and are here to guide you through the new regulations. If you need help understanding how these changes affect you or your business, don’t hesitate to contact us today. Our team in Perth, Brisbane, Melbourne, Sydney and Adelaide can provide you with tailored advice and support to ensure you remain compliant while maximising your financial benefits. Get in touch with us today.