With so many cloud-based bookkeeping resources to choose from, it can be difficult to land on the best one to meet your needs. Still, if you’ve already started your search, you’ve likely already come across two of the most popular options: MYOB and Xero.

From outsourced finance consultants to independent businesses, thousands of users have flocked to both choices — each for their own reasons. Though both solutions promise to make accounting tasks easier than ever, they do so in their own distinctive ways.

As such, you may be unsure which software would satisfy your requirements most efficiently. Don’t worry; we’re here to help. In this article, our bookkeeping experts will walk you through the advantages — and disadvantages — provided by both to help you make your final decision.

Table of Contents

MYOB: Best for Project-based Work

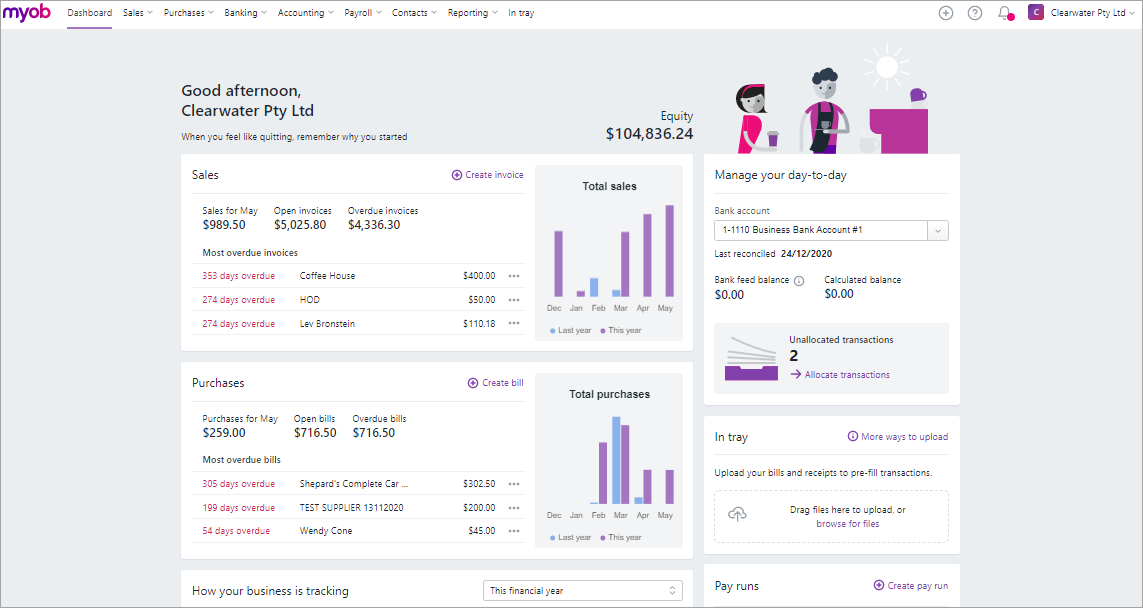

This cloud-based accounting software promises users a simple, hassle-free solution for managing their business finances. With a collection of features designed to streamline most accounting tasks, the resource is a trusted partner for hundreds of Australian businesses — though not as many as its Xero counterpart.

Granted, it still has a few worthwhile advantages prospective users should take note of, including:

- Easy Payments: Utilising the software’s MYOB Essentials platform, businesses can connect directly to PayDirect, allowing clients to submit payments via e-mail invoices and more.

- Cash Management: MYOB’s simple dashboard breaks down profits, expenses, income, and more for hassle-free financial planning.

- Tax Help: There isn’t a business that doesn’t need help come tax season, which makes MYOB’s built-in tax updates and payment system a huge plus.

- Project Tracking: In general, MYOB is best suited for project-based businesses thanks to its robust tracking features. From simple expense recording to timesheet logging, it has everything a manager needs to oversee every aspect of their project’s accounting resources.

With this in mind, let’s look at a few of the solution’s drawbacks.

- Clunky Bank Feeds: This portion of the service’s UI leaves something to be desired, as the feature offers a clunky experience.

- Limited Integration: Though it does provide a few quality choices, the solution doesn’t include the diverse third-party connections you might find with other alternatives.

Xero: Best for Transactions and E-commerce

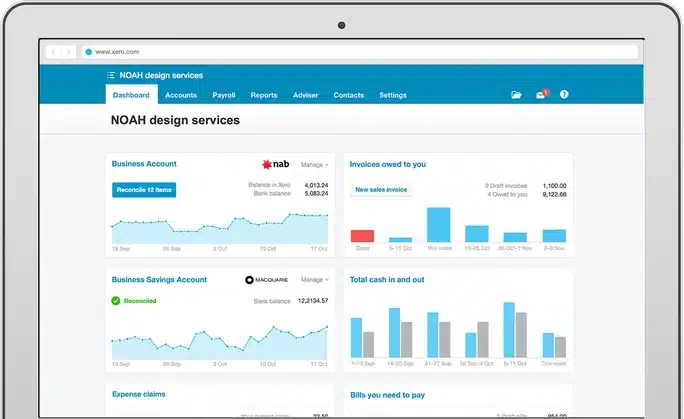

Like its competitor, this is another widely popular cloud accounting software. Since its establishment in New Zealand in 2006, Xero has strived to make financial management a breeze for companies large and small. Today, it’s used by millions of outsourced bookkeeping providers and other businesses.

So, what makes the solution a worthwhile option? Some of our favourite benefits include:

- Easy Access: Thanks to its fully web-based approach, users can access the platform when on the run via their devices. This also makes it simple for your outsourced accountants and bookkeepers to access your data and review your accounts in just a few clicks.

- Comprehensive Integration: Unlike MYOB, Xero’s list of third-party applications is extensive, allowing for further flexibility. As a result, it’s incredibly useful for e-commerce companies who may require multiple cloud services to handle transactions and other tasks.

- Beginner-friendly Design: Regardless of how experienced they may be in managing finances, any user can pick up Xero and begin using it immediately.

Now, let’s look at some disadvantages to note before making your decision.

- Repair Process: If you need to repair an error in your program, the UI will require more “clicks” to complete the fix compared to MYOB.

- Tracking Category Limit: Xero’s job codes, or tracking categories, limits users to four choices.

- Limited Support: Xero’s support team offers 24/7 online support, but it doesn’t accept phone calls. This can be an issue for those experiencing technical issues that require instant assistance.

Final Thoughts

Deciding on the tools you’ll utilise to handle your bookkeeping needs is no easy decision. From personal preferences to operational requirements, your final choice will — and should — depend on a series of careful considerations.

Fortunately, you don’t need to undergo this process alone. Please reach out to our outsourced, bookkeeping team to learn which accounting tools are right for your business.