The Australia-United Kingdom Free Trade Agreement (A-UKFTA) contains significant commitments that will strengthen diversification and COVID-19 recovery for both countries. Continue reading to find out what exactly is in the agreement and what this means for businesses in Australia.

Table of Contents

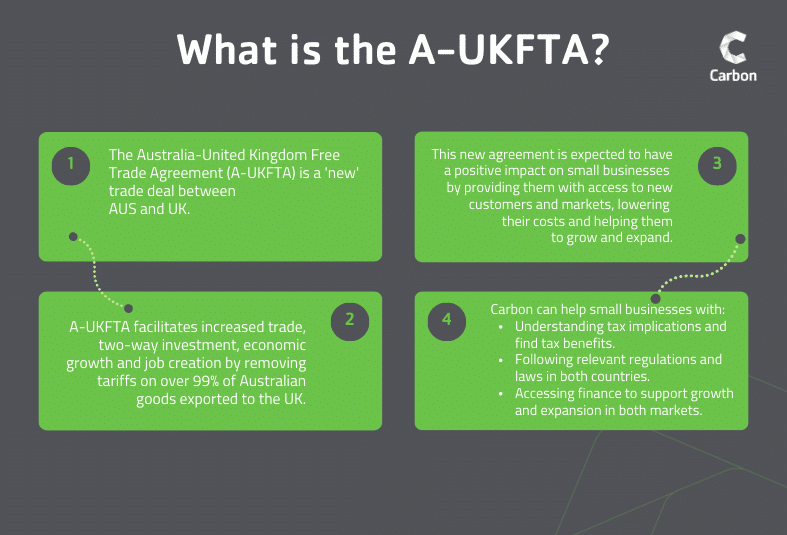

What is the A-UKFTA: Australia-United Kingdom Free Trade Agreement?

The Australia-United Kingdom Free Trade Agreement (A-UKFTA), signed on 17 December 2021, is a historic moment for our country’s relationship with the UK. The first ‘new’ trade deal since Brexit has been referred to as a gold standard trade agreement by the Government and facilitates increased trade, two-way investment, economic growth and job creation. 1 It does this by removing tariffs on over 99% of Australian goods exported to the UK. On 22 November 2022, the A-UKFTA passed the Australian Parliament.

Outcomes of the agreement include:

- Removing tariffs on:

- Australian wine

- Short and medium-grain rice

- Honey

- Nuts

- Olive oil

- Most seafood

- Most fruits and vegetables

- Most processed foods

- Duty-free transitional quotes and removal of tariffs after eight to ten years on:

- Beef

- Sheep meat

- Sugar and dairy

- Improved digital trade, including new rules around free flow of data, localisation commitments, and electronic contracts.

- Increased market access for financial services.

- Guaranteed right to bid for a wide range of UK government goods, services, and construction contracts.

- Extension of the working holiday arrangement to 3 years for people aged 18 to 35 working in Australia and the UK.

- New visa provisions to enable intra-corporate transfers and a new visa pathway to Australia for innovators from the UK.

- Two-way royalty arrangements for eligible artist resales. 2

What are the benefits of the A-UKFTA for small businesses?

The A-UKFTA provides significant benefits for small businesses in both countries by creating new trade and investment opportunities and reducing barriers to trade. This new agreement is expected to have a positive impact on small businesses by providing them with access to new customers and markets, lowering their costs and helping them to grow and expand.

One of the key provisions of the A-UKFTA that benefits small businesses is the elimination of tariffs on a range of goods traded between Australia and the UK including agriculture, automotive and manufacturing products. This will help small businesses lower their costs and increase their competitiveness in both markets.

Another benefit of the agreement is improved market access for services including financial, telecommunications and professional services. This will give small businesses the opportunity to access new customers and markets and help them to grow and expand. The agreement also includes provisions on investment protection and dispute resolution, providing small businesses with greater certainty and protection when investing in the UK or Australia.

The A-UKFTA also includes provisions for e-commerce making it easier and cheaper for small businesses to sell their products online to customers in the UK and Australia. This is particularly important in today’s digital age, where e-commerce has become an increasingly important channel for small businesses to reach customers and grow their businesses.

However, it’s important to note that the full impact of the A-UKFTA on small businesses will depend on how it is implemented and the regulatory environment in each country. This is where a financial services firm can play a crucial role in helping small businesses take advantage of the opportunities created by the agreement.

How a financial services firm can help small businesses looking to enter the UK market

A financial services firm can assist small businesses in understanding the tax implications of the A-UKFTA and help them take advantage of any tax benefits available under the agreement. The firm can also help small businesses manage their finances, ensure they are following relevant regulations and laws in both countries and access financing and lending to support their growth and expansion in both markets.

At Carbon, we offer a wide range of services including accounting, tax, bookkeeping, payroll, wealth management, business insurance, finance and lending, and R&D advice. Our financial advisors will be able to help you take advantage of the opportunities created by the agreement.

Take advantage of the A-UKFTA

Overall, the A-UKFTA is expected to create a more favourable and predictable business environment for small businesses operating in both countries, providing them with new opportunities for growth and expansion. However, it’s worth noting that the full impact of the agreement on small businesses will depend on how it is implemented and the regulatory environment in each country. You can read more about the A-UKFTA here.

A financial services firm can play a critical role in helping small businesses take advantage of the opportunities created by the agreement, by providing them with the support they need to navigate the complex financial and regulatory landscape created by the agreement. With the right support, small businesses can take advantage of the opportunities created by the A-UKFTA to grow and succeed in both markets. Get in touch with our experts today to see how we can help you grow.