It’s tax time again, and with tax time comes the inevitable influx of scam emails all designed with the same objective: to strip you of your hard-earned cash. So, to keep you and your money cyber-safe and secure, check out the latest scams doing the rounds, and take care with our tax-time safety tips.

JobKeeper Phone Scam

In an ingenious attempt to kick people when they’re down, there have recently been reports of phone scammers pretending to be from the Australian Taxation Office (ATO), calling to confirm bank account details for the JobKeeper payment. Remember that employees eligible for JobKeeper will always be paid by their employer, not the ATO (the ATO will reimburse the employer).

MyGov Scams

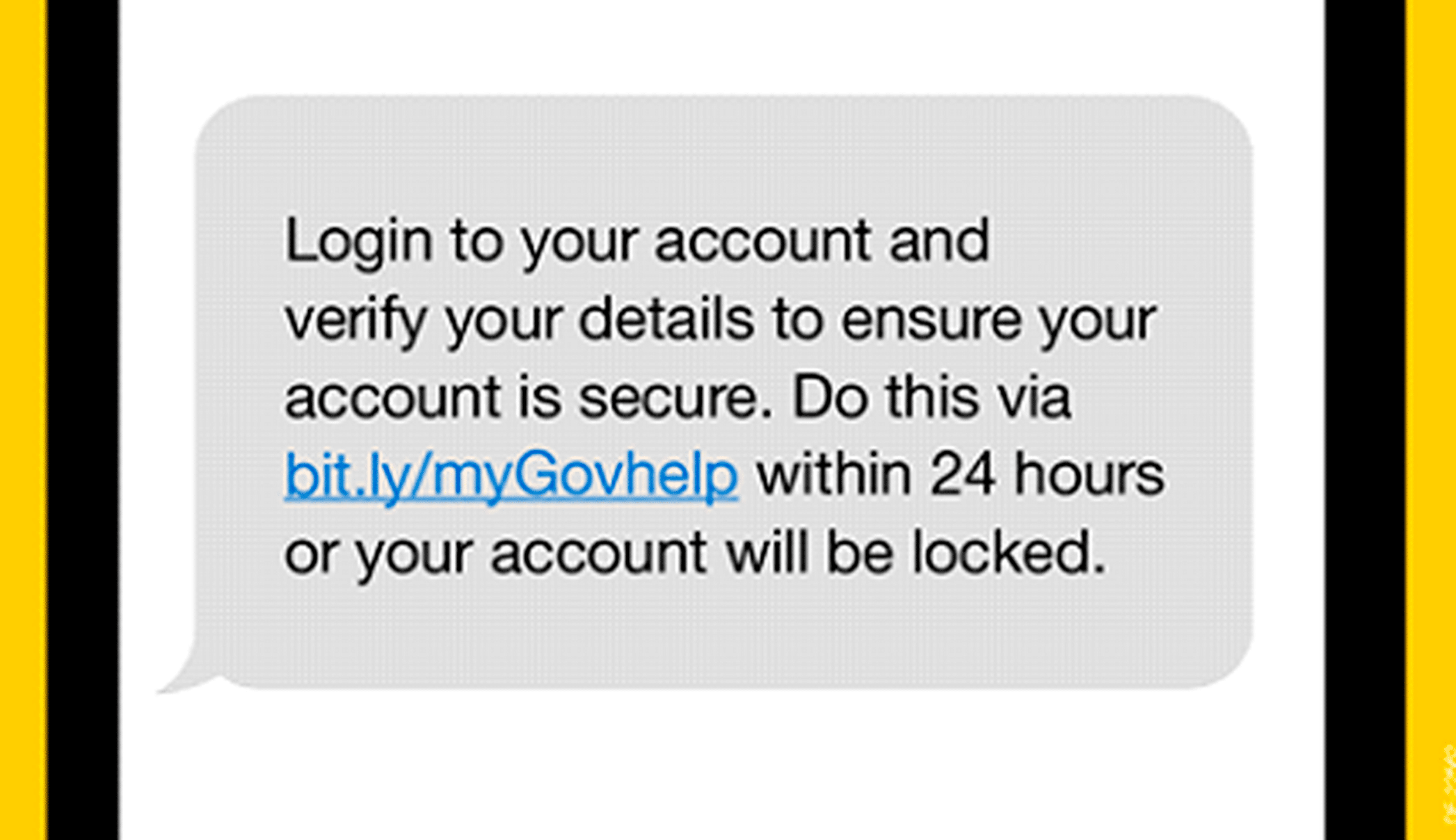

Mobile

If you get an SMS notification saying you have a new message in your myGov Inbox, with a link to log in via the message, it’s a scam. Only ever access online services directly via my.gov.au, ato.gov.au or the ATO app. Communications containing personal information like your tax file number (TFN) will always be sent to your myGov inbox… never to your mobile phone.

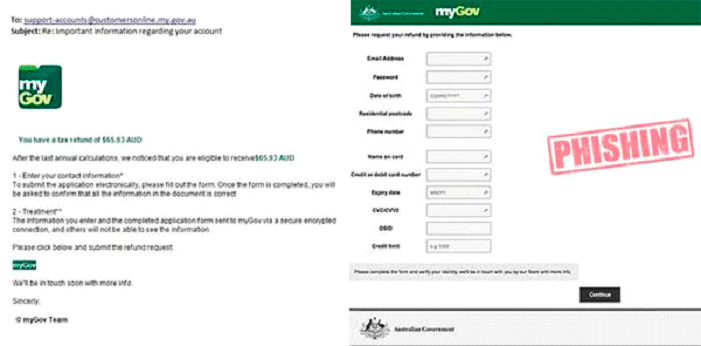

If a subject line ‘Important information regarding your account’ pops up in your inbox, and includes the myGov logo, beware. The email asks you to click on a link to claim your refund, which then takes you to a fake tax refund claim form. This email scam is designed to steal your personal and financial information… needless to say, do not click on the link.

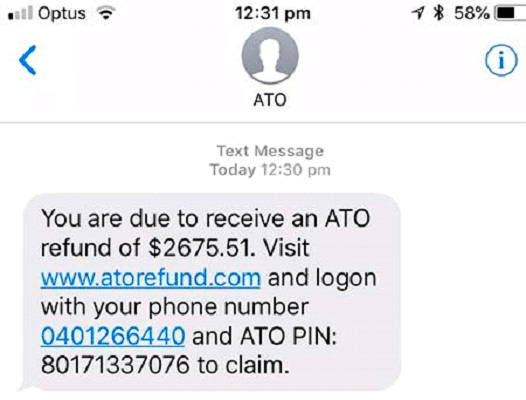

ATO Refund Scam

The ATO has issued a warning about scammers sending text messages from a number that’s seemingly from the ATO, asking people to click on a link and provide their personal details to obtain a refund. Again, never click on a text message link from a purported government body, no matter how legit it sounds… we guarantee it will not end well.

How can you tell if it’s a scam?

No government body, including the ATO, AFP, MyGov or Medicare, will ever:

- send you an email or SMS asking you to click on a link to provide login, provide personal or financial information, download a file or open an attachment;

- use aggressive or rude behaviour, or threaten you with arrest, jail or deportation;

- ask for payment directly to a personal bank account, via cryptocurrency or other methods such as pre-paid Visa cards;

- ask for a fee to release money owed to you;

- contact you using social media sites;

- send an email from an unknown email address.

Tips to stay safe

- Know the status of your tax affairs. If you’re aware of the details of any debts owed, refunds due and outstanding lodgments, you are less likely to fall victim to a scam;

- Do not click on links in emails or text messages claiming to be from myGov.

- Be very wary of messages that aren’t addressed directly to you or don’t use your correct name;

- Don’t open messages if you don’t know the sender, or if your gut tells you something’s up;

- Always log in to your official myGov account to check your inbox for any legitimate emails. The messages you get in your official myGov Inbox are secure and it’s safe to open any links included.

What to do next

Keep an eye on the latest scam alerts, and make sure you report it if you spot one that looks a little fishy by calling the ATO Scam Hotline on 1800 008 540. You can find out more about verifying or spotting a scam, but if you’re unsure whether you’ve been targeted just call us on (08) 6444 6645 and we’ll happily check it out for you. Get in touch with our experts today.