The risk of an ATO audit or review remains a reality for businesses, self-managed super funds (SMSFs) and individuals. With the ATO and other government revenue authorities using advanced artificial intelligence and data-matching tools, audits are becoming more sophisticated and frequent.

Rental property income and expenses, work-related deductions, employer obligations (PAYG/FBT/SG), income tax and GST are just some of the areas the ATO continues to target. Even businesses and individuals with meticulous record-keeping and the best intentions can still be subject to an unexpected audit or review.

Table of Contents

Increased Scrutiny Across Multiple Areas

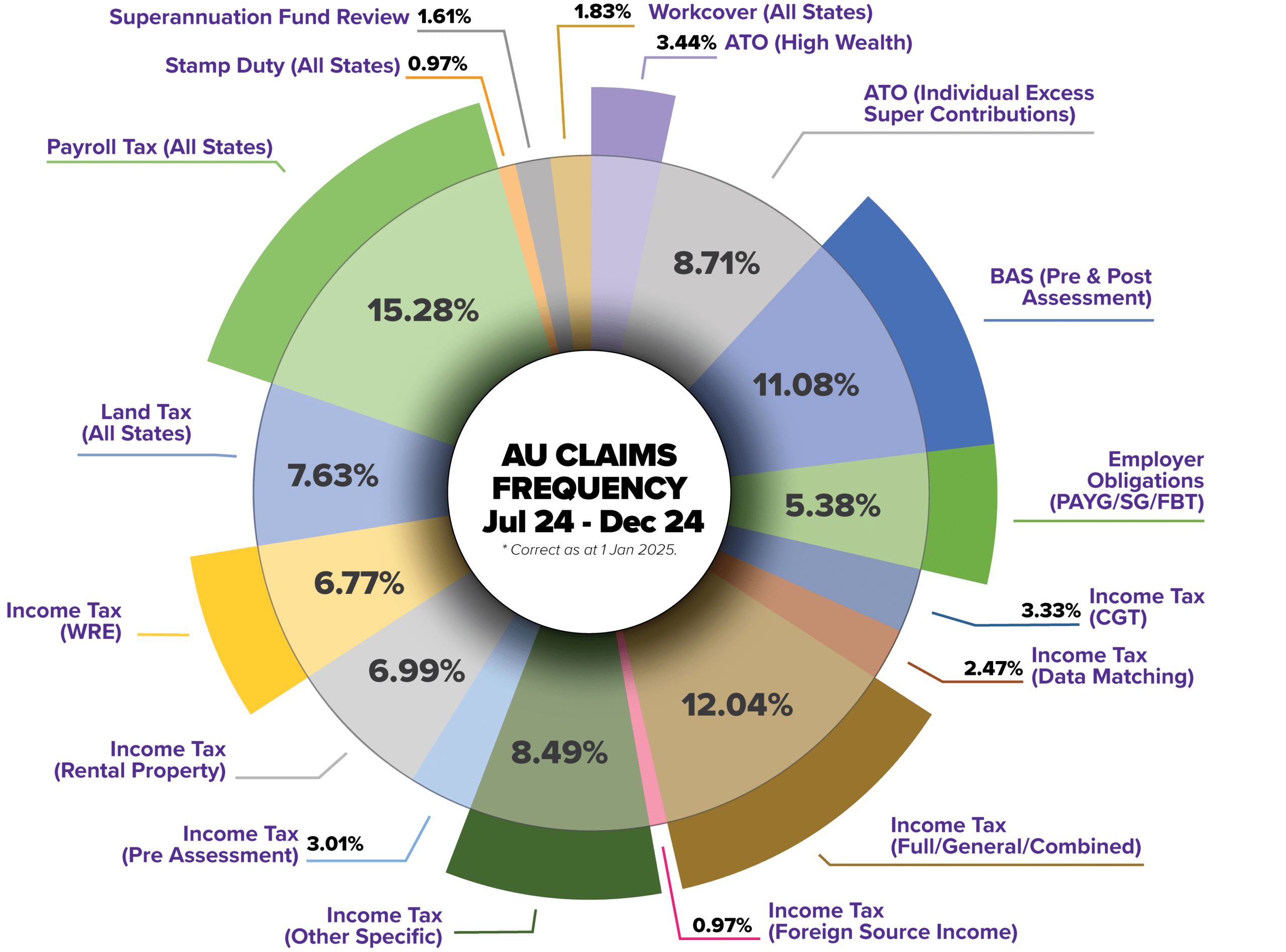

Recent data compiled by Accountancy Insurance from Australian tax audit claims between 1 July 2024 and 31 December 2024 highlights key areas where businesses and individuals are most likely to face ATO scrutiny. The most frequently audited and reviewed areas include:

- Payroll Tax (All States): 15.28%

- Income Tax (Full/General/Combined): 12.04%

- BAS (Pre & Post Assessment): 11.08%

Below is a chart outlining Audit Shield service claims across Australia for accounting firms offering Audit Shield from 1 July 2024 to 31 December, as compiled by Accountancy Insurance.

With a strong focus on businesses and individuals across multiple tax areas, it’s clear that compliance risk is strong. Even with the best intentions and accurate record-keeping, audits and reviews by the ATO and other government revenue authorities can happen unexpectedly.

The Financial Impact of an Audit or Review

When the ATO or another government revenue authority initiates an audit, review or investigation, the financial impact on businesses and individuals can be significant. Responding requires professional expertise, time and resources. Accountants play a crucial role in managing this process but the associated costs, especially when external specialists are needed, can add up quickly.

Even when no adjustments are necessary, the time and effort required to respond to an audit can be considerable. For small and medium businesses, this unexpected financial burden can disrupt cash flow and operations.

How Audit Shield Can Help

To help protect businesses and individuals from these unexpected costs, Carbon offers Audit Shield, a service powered by Accountancy Insurance that covers professional fees incurred when responding to audits, reviews, inquiries, or investigations initiated by the ATO and other government authorities.

Key Benefits of Audit Shield:

- It’s tax-deductible: A bonus of the Audit Shield service is that you can add it to the list of your tax deductions each year.

- You’re comprehensively covered: All of your current and previously lodged returns are covered by the Audit Shield service, even if you had another accountant taking care of your tax affairs in the past.

- There are no unplanned fees: Where there are adjustments required to your lodged returns, our Audit Shield service will cover the cost of the professional fees, including specialists we may need to engage to assist us on your behalf (up to the prescribed cover limit).

- The ATO continues to invest in compliance efforts: With dedicated funding allocated each year to conduct audits, investigations and reviews of lodged returns for individuals, businesses and SMSFs across Australia. With such resources available to the ATO audit activity will most likely increase, even to those who have previously not been targeted.

Ensuring Peace of Mind with Carbon

We know that dealing with an ATO audit or review can be stressful and time-consuming. That’s why Carbon offer Audit Shield to clients, ensuring they have protection from unexpected professional fees associated with compliance activity. Our team is here to support you in managing your tax obligations while minimising financial disruptions caused by audits.

If you’d like to learn more about Audit Shield and how it can provide protection in the event of an ATO audit, reach out to our team today.