Retention Track clears the retention headache with simple, centralised software to manage trust accounts, claims and retention balances.

In this blog, Retention Track explains how to handle retentions correctly so you can protect cash flow, minimise tax errors and recover funds on time. You’ll also find easy habits that keep subcontractors, builders and accountants organised and up to date on contractual payments, including ways a Virtual Assistant can support the process.

Table of Contents

- What is Retention Money in Construction?

- Retentions are Bigger Than They Look

- Consistent Accounting Treatment Matters

- Keep Up With Local Rules and Trust Account Requirements

- How Retentions Work in Practice

- What Does This Mean For Us?

- Recovery of Retention Money

- What To Do Next

- How Carbon Can Help

- About Retention Track

What is Retention Money in Construction?

Retention money is part of a payment withheld by a head contractor from a subcontractor’s invoice until specific conditions are met, usually tied to completion or quality of work. It acts as a financial safeguard to ensure the sub-contractor fulfils their obligations under the contract.

Retention amounts vary by contract but a common approach is 5% of the contract value, with half released at Practical Completion (PC) and the other half released about 12 months later at the end of the Defects Liability (DL) period.

Retentions are Bigger Than They Look

In Australia, the construction industry is worth more than $568 billion (ABS, 2024). Within this, around 450,000 subcontractors account for 40% of industry income or roughly $227 billion. Based on these figures, it’s estimated that at any one time, there is about $18 billion in contract retentions outstanding.

On average, that equates to around $40,000 owed to each subcontractor, many of whom turn over between $600,000 and $1 million annually. For businesses of this size, retention balances can have a major impact on cash flow if they aren’t tracked and recovered properly.

Consistent Accounting Treatment Matters

Across the industry, retention accounting is inconsistent. Some methods treat retentions as income too early, leading to GST and income tax being paid before the cash is received. Others fail to record the retention balance at all, increasing the risk of never chasing it and effectively forfeiting the money.

Keep Up With Local Rules and Trust Account Requirements

Retention money has recently become a policy focus. For example, Western Australia and Queensland have legislated handling requirements for retention money, including the use of specific bank accounts and clearer recovery pathways. New Zealand has also introduced rules, and the UK Department for Business & Trade has consulted on tackling poor payment practices in construction. Check the requirements for your jurisdiction and keep your process current.

How Retentions Work in Practice

Accounting for retention can be tricky and several methods are used in the field. In the example below, a subcontractor, Ned’s Electrical, invoices a head contractor, Tower Builders, for $100. The retention is 5% net of GST.

Four Common Accounting Treatments (Pros & Cons)

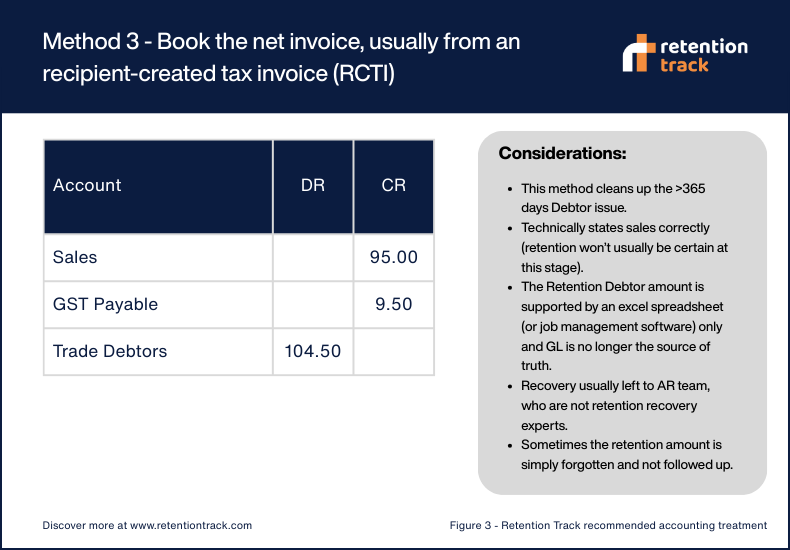

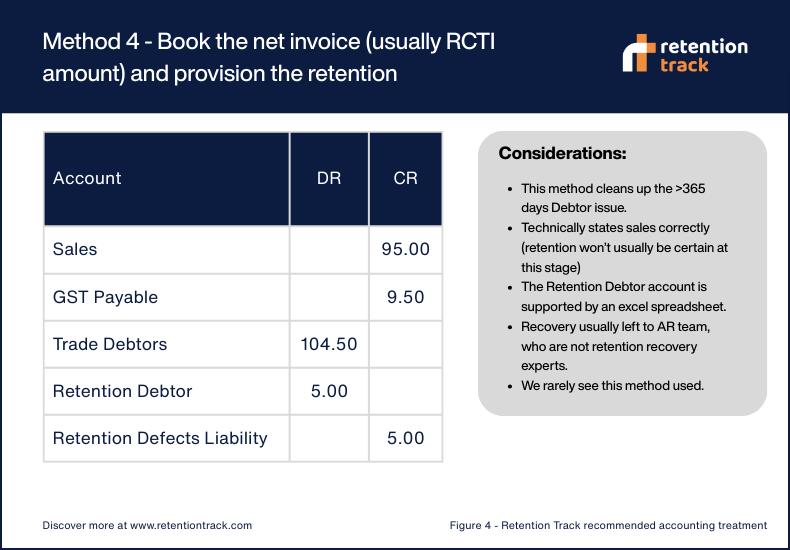

Acronyms used below: RCTI = recipient-created tax invoice. GL = general ledger.

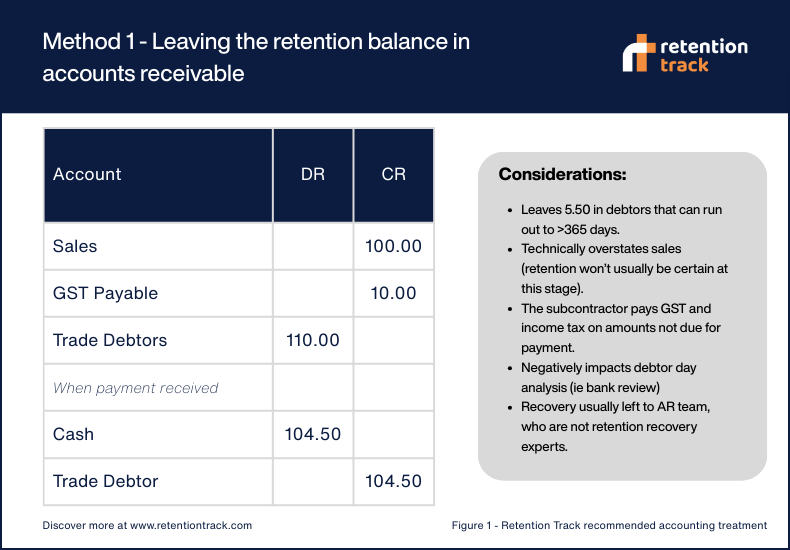

- Method 1: Leave retentions in accounts receivable (A/R)

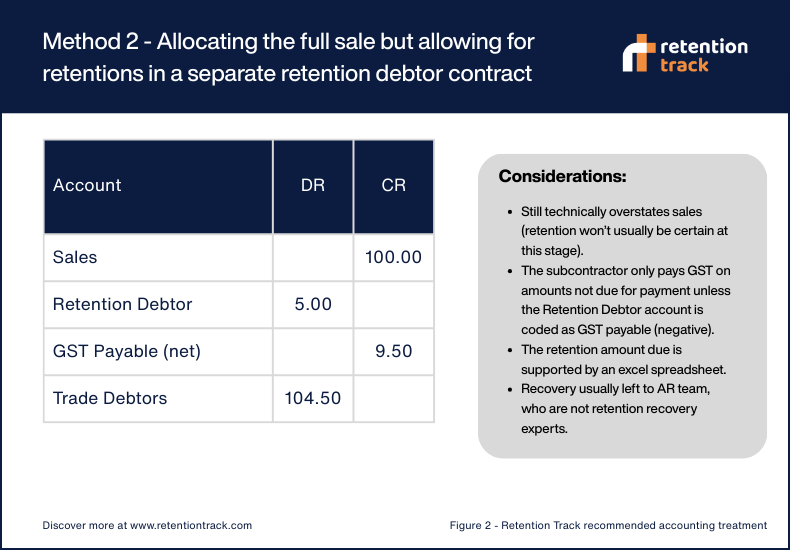

Simple to operate, but can overstate income and GST if retentions are treated as earned too early. - Method 2: Record full sale and use a separate retention account

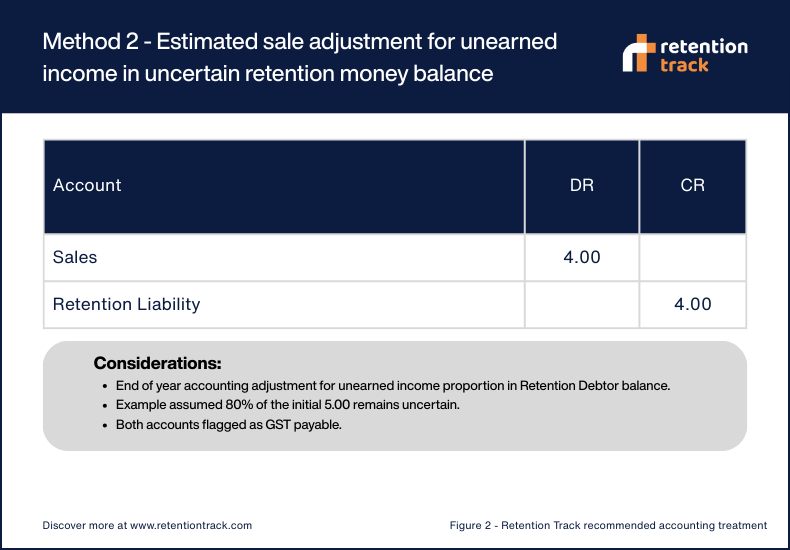

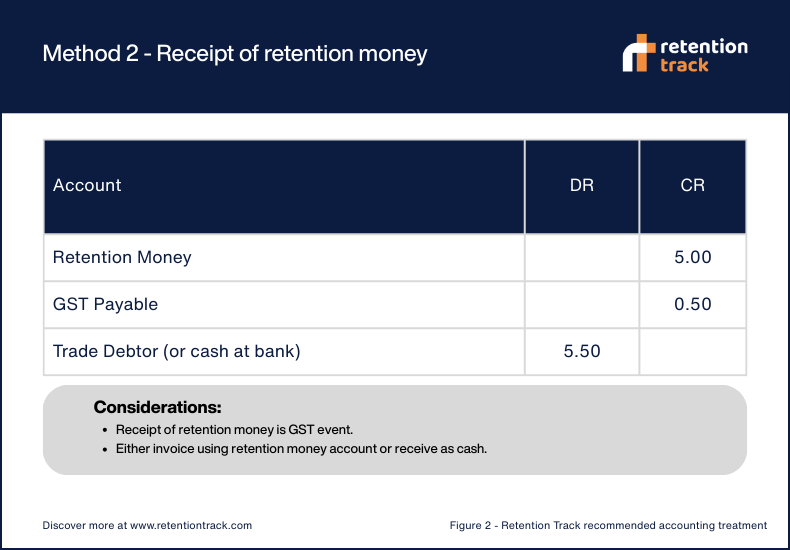

Method 2 can overstate sales but is easier to invoice and handle. The sales overstatement can be practically managed at an accounting level by taking a view of the retention balance at each reporting date and making this adjustment. - Method 3: Record the net invoice (e.g. via RCTI) and track retentions outside the GL

Works if your off-GL register is accurate and reconciled. The risk is losing visibility if the external register isn’t maintained. - Method 4: Record the net invoice and provision for retention in the GL

Method 4 is the most correct way of bookkeeping for retention but does create some practical handling challenges.

What Does This Mean For Us?

Retention treatment has a direct impact on tax and cash flow:

- Method 1 (leave in A/R): If retentions sit in accounts receivable for more than 90 days, GST may already have been overpaid. If balances sit for more than 270 days, income tax may also be overstated. On a $100,000 retention balance, this could mean around $35,000 in unnecessary GST and tax paid early.

- Method 2 (full sale + retention account): GST handling is generally correct but if balances remain in A/R over 270 days, income tax may still be overpaid. On $100,000, that could be roughly $25,000.

- Method 3 (net invoice + off-GL tracking): Works if records are perfect but any lapse risks “profit leakage” where retentions are never chased. A quick test of three contracts will often show $10,000–$50,000 in unclaimed amounts.

- Method 4 (net invoice + GL provision): Considered the most correct but reconciling the GL retention balance can be complex and prone to mistakes.

For most businesses, even a basic review of retention handling can reveal immediate cash flow and profit improvements.

Recovery of Retention Money

Retention money is typically released in two stages:

- At Practical Completion (PC): Half of the retention is usually released once the project reaches practical completion. Recovery at this stage is often smoother, as subcontractors are still directly engaged with the head contractor or project manager.

- At the end of the Defects Liability (DL) period): The remaining half is released once the defect liability period ends (commonly 12 months later). Recovery here is often harder, as responsibility for chasing falls to the accounts receivable team, and head contractors may delay payment by raising defect rectification issues.

Historically, disputing a retention balance required adjudication and significant legal costs. For example, a subcontractor chasing a $2,000 retention could easily spend $5,000 or more in legal fees — hardly worth the effort. As a result, many subcontractors have chosen not to pursue smaller amounts, leaving money unclaimed.

In Western Australia, the Building and Construction Industry (Security of Payment) Act 2021 now provides a pathway to adjudication for retention payments. The process, however, can still be complex, making accurate records and a clear timetable essential.

Where Retention Track Helps

- Encourages correct accounting for retentions and provides tools within the platform to correct current accounting methods (when linked to Xero).

- Provides an active reconciliation of retention balances to the GL (the GL is the best source of truth for a retention balance).

- Provides an active walk-through with (captive) email communications in line with the Building and Construction Industry (Security of Payment) Act 2021.

In addition, Retention Track helps create a disciplined environment for managing retentions and the contracts they belong to. This not only saves time and reduces stress but also delivers real improvements to cash flow and profit.

What To Do Next

The easiest thing to do is get in contact with Retention Track, and they can talk through any scenario and provide a demo (even better with the real data).

Alternatively, start with low-effort housekeeping that builds discipline:

- Using separate ledgers or sub-accounts for retention tracking.

- Reconciling retention ledger balances monthly to an Excel report.

- Comparing contract totals for revenue and retention to actual invoicing.

- Tracking contract variations that impact the timing of PC and DL dates.

- Including retention in cash flow forecasts.

- Following up on retention balances due and training staff to use the documentation framework within the local act.

Prefer to automate? Retention Track offers usage-based pricing from $20 + GST per contract (no subscription required).

How Carbon can help

Getting retentions right touches accounting, bookkeeping, admin and systems. Carbon can help you:

- Review your current treatment for retentions (GST, income recognition, A/R ageing) and flag quick wins for cash flow.

- Set up simple workflows in Xero and your job system to track retention balances, PC/DL dates and reminders. Then integrate or transition to Retention Track for full automation.

- Build a practical retention review process (basic reports and checklists) to stop balances slipping through the cracks, while identifying where automation could add value.

- Train your team on the documents required under local Security of Payment rules.

- Work with our Virtual Assistant team for admin-heavy tasks like reconciling ledgers, updating PC/DL schedules and chasing reminders; freeing you to focus on higher-value work.

- Introduce Retention Track where automation makes sense and coordinate the handover.

Speak with your Carbon adviser or get in touch with us for a quick retention health check. We’ll outline the fixes and, if it’s right for you, set up a pilot with Retention Track using real data.

About Retention Track

Retention Track Pty Ltd is a WA-based company that saw an opportunity to automate the complex Building and Construction Industry (Security of Payment) Act 2021. This then expanded into the accounting and basic contract treatment of retentions. Retention Track is owned by Mark and James Coulson. Mark has been in the construction industry for 20 years as a surety bond broker and is very aware of the industry retention issues. James is a software engineer and was previously an actuarial analyst with one of the Big Four firms in Sydney. Retention Track operates in Australia and New Zealand, with a UK rollout planned for November 2025.