Are you looking for strategies to minimise your taxes before the end of the financial year in Australia? If so, you’re not alone. Continue reading to find out how you can benefit from strategies that will reduce your overall tax benefit.

Table of Contents

What is tax planning?

Tax planning refers to the various actions that are taken before the end of the financial year (30 June), to achieve better tax, business and personal outcomes. The goal of tax planning is to help you minimise your taxes, avoid costly penalties from the ATO and make the most of your hard-earned money. With our professional, easy-to-read approach and commitment to compliance, we’re the go-to team for tax planning in Australia.

Strategies for effective tax planning

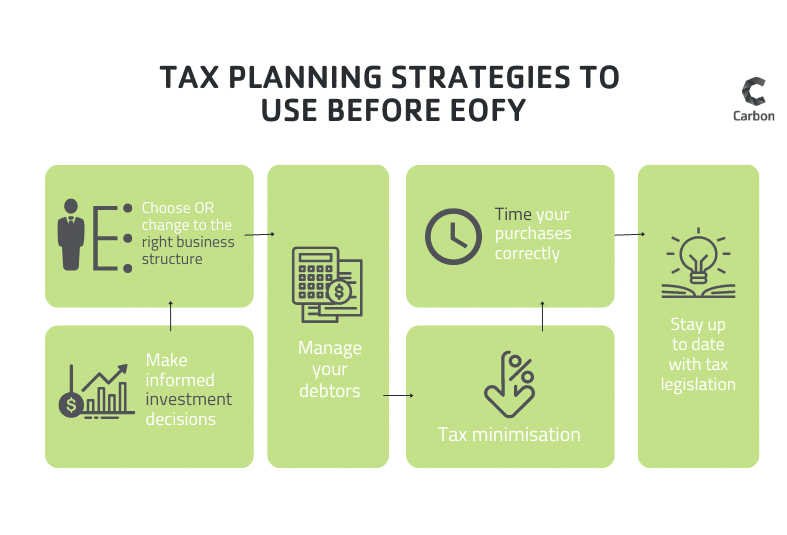

Here are some of the key strategies you should consider for effective tax planning.

Reduce your taxes

Reducing tax or ‘tax minimisation’ is not about avoiding tax (which is illegal) but is about helping you find ways to save on tax. This is what business owners are most concerned about, and good tax plans will show multiple scenarios to help you find ways to save on tax based on different levels of expenditure and profit estimation. This will also help you budget for any pending tax debts.

The start of a new financial year is often the time when businesses assess their financial position and make plans for the future. By having the right business structure in place before this time, you can ensure that your business is structured in the most tax-efficient and legally compliant way. Additionally, making changes to your business structure after the start of a new financial year may require you to restate your financial accounts, which can be time-consuming and costly.

Make informed investment decisions

Evaluate the cost-benefit of making an investment, such as purchasing a rental property or commercial property. This will help you assess the impact on your cash flow and tax position.

Manage your accounts receivable

Make sure you review your debtors, also known as accounts receivable. If there is money owed to your business that is not recoverable (such as your debtor has gone bankrupt), consider writing off the amount as a bad debt. You may be able to receive a tax deduction.

Time your purchases

Timing your purchases correctly can have a big impact on your tax position and help you save money. Prepaying expenses, for example, allows you to claim deductions in the same year, rather than spreading it over multiple years. This can also improve your cash flow by delaying tax payments. To maximise the benefits, it’s crucial to time purchases before the end of the financial year.

Maximise your superannuation contributions

Set yourself up for retirement without affecting your current lifestyle or immediate plans (kids’ school fees, business expansion etc).

Making contributions to your superannuation is also a tax-effective way to save, as contributions made from your pre-tax income are taxed at a lower rate than your regular income. This means that by making contributions to your super, you can reduce your taxable income, potentially lowering your overall tax bill.

Stay up to date with tax legislation

Since small business rules are known to change quite often, make sure you review your current business strategy and are keeping up with the most recent tax legislation.

Why work with an accountant for tax planning?

Working with an accountant for tax planning is a smart choice for any business owner who wants to minimise their taxes, ensure compliance and achieve their financial goals.

Tax planning with your accountant is especially important for the following reasons:

Timing of purchases

Buying an asset even a day late could result in thousands of dollars of tax that could have been delayed for another 12 months, as we know cashflow is crucial to many small businesses. Your accountant will help you make the right decisions at the right time.

Staying away from tax avoidance schemes

Avoid penalties from the ATO by ensuring your affairs are fully compliant. Your accountant will help you avoid tax avoidance schemes and make sure you’re not involved in any scams.

Some tax avoidance schemes are easy to recognise (advice from unqualified people who aren’t qualified accountants) and some are harder to recognise (individuals or groups who promote tax avoidance schemes that appear to be professional – e.g. some scam businesses have promoted early access to your superannuation tax-free). Unfortunately, the ATO will still issue penalties even if you were unaware you were participating in a tax avoidance scheme, so checking with your accountant before you act is a must.

Stay on top of your lodgement dates

One of the easiest ways to save on tax is to avoid penalties and interest for late lodgement, as well as penalty tax for dubious claims. By ensuring you lodge your tax returns on time and only claim legitimate deductions, you can avoid costly penalties and reduce your tax bill. So, take a proactive approach to your tax planning and stay on top of your lodgements to enjoy the benefits of a lower tax bill and greater financial security.

Avoiding unnecessary spending

Don’t spend money just to get a tax deduction. Spending $1 does not equal a $1 reduction in tax so only spend money to get a tax deduction if it makes sense for your circumstances.

Your accountant will help you make informed decisions that make sense for your circumstances.

Start the tax planning conversation with an accountant

Tax planning is a crucial aspect of running a successful business in Australia. With the right strategies in place, you can minimise your taxes, protect your financial and personal goals and ensure compliance with tax laws and regulations.

So, if you’re looking for professional, reliable tax planning services in Australia, look no further. With our commitment to compliance, easy-to-read approach and focus on minimising your taxes, our tax accountants are here for all your tax planning needs.

Tax planning season kicks off in February, so now is a great time to sit down with us and ensure you are on track with your financial and personal goals. Often tax planning meetings will generate discussion and allow your accountant to be proactive to reduce taxes for many years into the future, not just the current financial year. Contact us today to schedule a consultation and start planning for a successful financial year.