If you’ve been considering changing to a fixed rate mortgage, now may be the perfect time as experts from the biggest lenders in Australia have predicted a rise to interest rates by the middle of 2022. 1

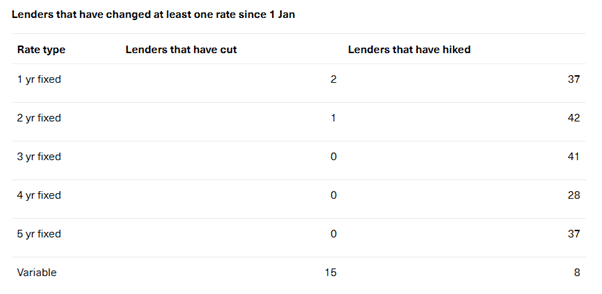

According to RateCity, all four big banks (CBA, Westpac, NAB and ANZ), have now hiked fixed rates this year. 2

Source: RateCity.com.au. Note some lenders have moved multiple rates.

Fixed interest rates vs variable interest rates

Whether you’re applying for a new mortgage or refinancing your current mortgage, it’s important to understand the differences between fixed and variable interest rates. Knowing the difference will not only help improve your financial health but will allow you to meet your financial goals.

Variable interest rate loans are loans that change over time based on external factors such as lender market position, the Reserve Bank’s official cash rate and the Australian economy. 3 Variable rates allow more freedom, but not being able to budget for the future can be stressful.

Fixed interest rate loans are loans in which the interest rate doesn’t change for a fixed term (typically one to five years), even if the market interest rates do. At the end of your fixed term, you can choose to re-fix at the new offered rates or change to a variable interest rate.

Benefits of a fixed-rate mortgage

The main reason people lock in a fixed rate home loan is that if interest rates rise, they’re already locked into a lower rate and their repayments cannot be changed.

When you lock in or fix your interest rate for a period, it’s easier to budget and plan.

Restrictions of a fixed-rate mortgage

Fixed loans don’t always work for everyone. For example, if you’re on a fixed rate home loan and interest rates decrease, you run the risk of missing out on potentially lower mortgage repayments because you chose to fix your home loan for that period.

Fixed-rate mortgages also limit your flexibility with refinancing, offset accounts and redraw facilities. If you decide that you want to remortgage, pay off your mortgage early or change back to a variable rate, you may need to pay break fees for ending your fixed-rate period early.

Things to consider

Deciding whether to fix or not to fix your home loan rate is a big decision and if you don’t properly investigate, you might find yourself locked into something you aren’t comfortable with.

It’s important to remember that if you don’t want to pick between fixed or variable rates, or if you want the best of both worlds, you can choose both. Split loans don’t have to be 50/50 but can be 80% fixed, 20% variable, or whatever the borrower and lender agree on. By splitting your loan, you can enjoy the benefits of both home loans. 3

How we can help

While your first instinct may be to talk to your bank about home loans, talking to a finance broker first may save you money, time, and effort.

At Carbon Finance & Lending, our finance brokers have access to an extensive panel of lenders and can explore better solutions that suit your financial needs. Everyone’s personal circumstances are different, and our brokers can help guide you through your home loan journey. Get in touch with us today to get started.